Are you tired of budgeting the same way year after year, only to find yourself struggling with cash flow? Then it’s time to explore zero-based budgeting (ZBB). This powerful budgeting method starts from scratch each period, requiring you to justify every single expense. Unlike traditional budgeting, which relies on previous years’ spending as a baseline, ZBB forces you to prioritize your spending based on your current needs and financial goals. This approach eliminates unnecessary expenses and improves financial accountability, leading to better financial control and more efficient allocation of your resources.

This guide provides a simple explanation of zero-based budgeting, outlining its core principles and benefits. We will demystify the process, providing practical steps to implement ZBB effectively, regardless of your experience level. Learn how to create a zero-based budget that aligns perfectly with your financial objectives, empowering you to achieve your financial aspirations. Discover how ZBB can help you take control of your finances, eliminate wasteful spending, and build a strong financial foundation. This comprehensive guide will equip you with the knowledge and tools needed to successfully implement zero-based budgeting in your personal or professional life.

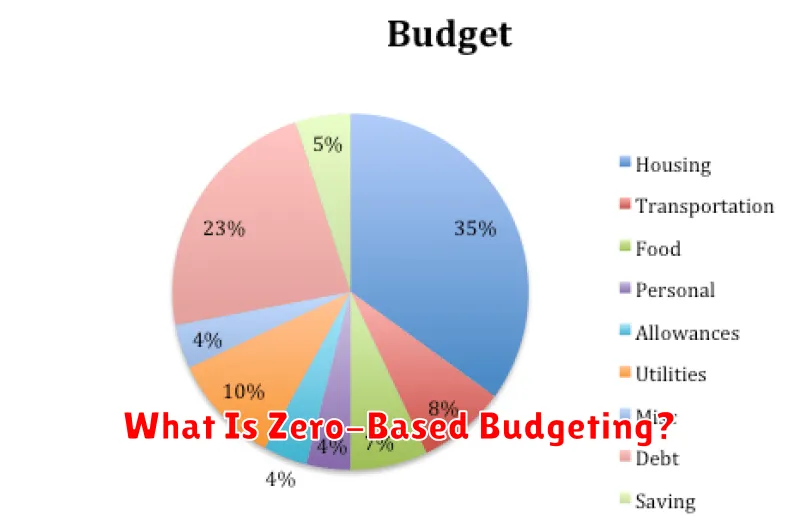

What Is Zero-Based Budgeting?

Zero-based budgeting (ZBB) is a budgeting method where each budget cycle starts from zero. Unlike traditional budgeting, which often uses the previous year’s budget as a base and makes incremental adjustments, ZBB requires each expense to be justified and approved from scratch.

This means that every department or function within an organization must demonstrate the need for every expense, regardless of whether the expense was included in the prior year’s budget. It’s not a matter of simply increasing or decreasing existing line items; instead, all expenditures must be evaluated for their contribution to the overall goals and objectives of the organization.

The process involves building a budget from the ground up, justifying each spending request with supporting data and analyses. This rigorous process ensures that resources are allocated efficiently and effectively, focusing on activities that deliver the greatest value.

Key aspects of ZBB include: defining decision packages, ranking those packages based on priority and impact, and allocating resources according to the ranking. This forces departments and managers to be more strategic in their spending plans and to prioritize initiatives that align with organizational goals.

While it can be a more time-consuming and resource-intensive process than traditional budgeting, the benefits of ZBB—improved resource allocation, increased efficiency, and better financial control—often outweigh the costs for organizations committed to its implementation.

How It Differs From Traditional Budgets

Traditional budgeting, often called incremental budgeting, operates on the principle of using the previous year’s budget as a base. This year’s budget is then typically adjusted upwards or downwards by a small percentage. This process, while seemingly simple, can lead to inefficiencies and unnecessary spending over time.

In contrast, zero-based budgeting (ZBB) starts from a clean slate. Every expense must be justified and approved from scratch each budget cycle. There’s no automatic carryover of past expenditures. Instead, each department or program starts with a budget of zero and must demonstrate the need for every dollar requested.

This fundamental difference leads to several key distinctions. Firstly, ZBB promotes a more critical evaluation of every expense item, identifying potential areas for cost savings and improved resource allocation. Traditional budgeting, by its very nature, tends to perpetuate existing spending patterns, even if they are no longer effective or necessary.

Secondly, ZBB encourages a more strategic and proactive approach to resource management. Departments are forced to prioritize their activities and align them with the overall organizational goals. Traditional budgeting, on the other hand, often results in a less focused approach to resource allocation.

Finally, the implementation of ZBB requires a significant shift in organizational culture and a greater emphasis on data-driven decision making. It demands more time and effort initially, but the long-term benefits in terms of cost savings and improved efficiency can be substantial, in stark contrast to the potentially passive nature of traditional budgeting.

Steps to Build a Zero-Based Plan

Building a zero-based budget requires a structured approach. It’s not about cutting expenses haphazardly, but rather a systematic reallocation of resources based on your priorities.

The first step is to determine your financial goals. What are you hoping to achieve? Paying off debt? Saving for a down payment? Clearly defining your objectives provides a framework for your budget.

Next, list all your income sources. This includes your salary, any side hustles, investment income, and any other regular sources of funds. Be thorough and accurate.

Then, you need to categorize your expenses. This is where you list every single expenditure, no matter how small. Categorize them logically, for example: housing, transportation, food, entertainment, debt payments, etc. Be as specific as possible.

Now comes the crucial step: allocate your income to each expense category. Start with zero and assign funds to each item based on its necessity and alignment with your financial goals. This necessitates making conscious decisions about what is essential and what can be reduced or eliminated.

After assigning funds to essential expenses, consider discretionary spending. This is where you allocate any remaining funds to things like entertainment and hobbies. This may require tough choices, but the process ensures that discretionary spending doesn’t jeopardize your goals.

Finally, regularly review and adjust your zero-based budget. Life changes, priorities shift, and income fluctuates. Regular review (monthly or quarterly) ensures your budget remains relevant and effective.

Track Every Dollar Earned and Spent

The cornerstone of zero-based budgeting is meticulous tracking. This means recording every single dollar that comes in and goes out. No amount is too small to ignore; every coffee, every grocery item, every subscription fee needs to be accounted for.

You can achieve this through various methods. Some prefer using budgeting apps, while others opt for spreadsheets or even a simple notebook. The key is to find a system that suits your personal preferences and technological proficiency and stick with it consistently. The more accurate your tracking, the more effective your budget will be.

Categorization is crucial. As you record your transactions, assign each one to a specific category (e.g., groceries, transportation, entertainment). This allows you to analyze your spending patterns and identify areas where you might be overspending. This level of detail is essential for identifying areas for potential savings.

Regularly reviewing your transactions is also essential. Aim for a weekly or bi-weekly review to ensure accuracy and catch any discrepancies early on. This regular check-in prevents small errors from snowballing into significant budget imbalances.

The initial effort required for thorough tracking might seem daunting, but the benefits far outweigh the time commitment. Accurate tracking provides invaluable insight into your financial habits, enabling you to make informed decisions about your spending and saving.

Tips to Stay Consistent Monthly

Maintaining consistency with your zero-based budget requires diligent effort and a commitment to your financial goals. Here are some key strategies to help you stay on track each month:

Plan Ahead: Don’t wait until the end of the month to assess your spending. Review your budget regularly, ideally weekly, to identify potential overspending or areas where you can adjust your allocations. This proactive approach prevents surprises and allows for timely corrections.

Track Every Dollar: Accurate spending tracking is paramount. Utilize budgeting apps, spreadsheets, or even a simple notebook to meticulously record every expense. This detailed record provides a clear picture of your financial habits, highlighting areas for improvement and reinforcing mindful spending.

Automate Savings and Bill Payments: Automating your savings and bill payments streamlines your finances and minimizes the risk of missed payments or forgetting to save. This eliminates manual effort and ensures consistent allocation of funds towards your prioritized goals.

Review and Adjust Regularly: Life changes, and so should your budget. Regularly review your budget (monthly is ideal) to adapt to unforeseen expenses or shifts in income. Flexibility is key to long-term success with zero-based budgeting; adjust allocations as needed to keep your plan relevant and effective.

Embrace the Power of “No”: Learning to say “no” to non-essential purchases is crucial for zero-based budgeting. Prioritize your needs over wants, and avoid impulsive spending to maintain control over your finances and stay within your allocated budget.

Celebrate Small Wins: Acknowledge and celebrate your successes along the way. Recognizing your progress boosts motivation and reinforces the positive habits you’re developing through consistent budgeting. This positive reinforcement helps to solidify your commitment to your financial plan.

Best Tools to Use

Implementing a zero-based budget effectively often requires the assistance of specialized tools. These tools can streamline the process, improve accuracy, and enhance overall efficiency.

Spreadsheet software, such as Microsoft Excel or Google Sheets, remains a popular choice. Their flexibility allows for customized budgeting models, facilitating detailed tracking of revenue and expenses. However, managing complex budgets in spreadsheets can become cumbersome for larger organizations.

Dedicated budgeting software offers a more comprehensive solution. These platforms provide pre-built templates, automated calculations, and collaborative features, simplifying the process significantly. They often incorporate advanced functionalities like forecasting and reporting, providing valuable insights into your financial health. Some popular options include budgeting apps designed for individuals and smaller businesses, and enterprise-level software for larger corporations.

Regardless of the tool chosen, successful zero-based budgeting hinges on accurate data entry and consistent monitoring. The best tool is ultimately one that aligns with your organization’s size, complexity, and specific needs. Consider factors like ease of use, reporting capabilities, and integration with existing accounting systems when making your selection.