Understanding how your credit limit is determined is crucial for managing your credit cards effectively. This knowledge empowers you to make informed decisions regarding your finances and avoid potential pitfalls. A higher credit limit can be beneficial, offering increased spending power and potentially boosting your credit score. Conversely, a low credit limit can hinder your financial flexibility and even negatively impact your creditworthiness. This article will delve into the factors that lenders consider when setting your credit limit, providing you with valuable insights into this important aspect of personal finance.

We’ll explore the key variables that influence your credit limit, from your credit history and credit score to your income and debt-to-income ratio. Learning how these factors interact will help you understand why you might be offered a particular credit limit and what steps you can take to potentially increase it in the future. Understanding the credit limit process is essential for responsible credit card management and achieving your overall financial goals. Discover how to navigate this critical aspect of personal finance and unlock a deeper understanding of your creditworthiness.

What Factors Impact Credit Limits?

Several key factors influence the credit limit a lender offers. Understanding these elements can help you better manage your expectations and improve your chances of securing a higher limit.

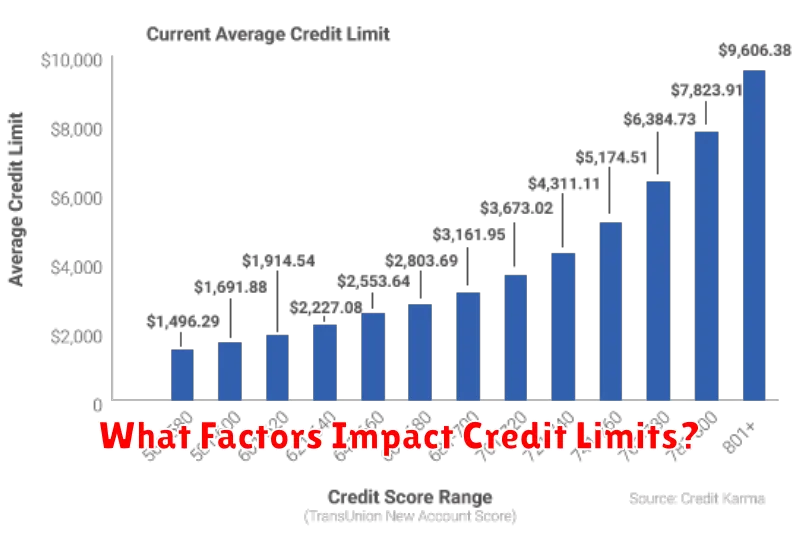

Your credit score is arguably the most significant factor. A higher credit score, reflecting responsible credit management, typically results in a higher credit limit. Lenders view a strong credit history as an indicator of lower risk.

Your credit history length also plays a crucial role. A longer history demonstrates a proven track record of managing credit responsibly over an extended period. This provides lenders with more data to assess your reliability.

The amount of available credit you currently have (your credit utilization ratio) significantly impacts your credit limit offers. High utilization rates—using a large percentage of your available credit—can negatively affect your score and reduce the limit offered by new lenders.

Your income and debt levels are also carefully considered. Lenders assess your ability to repay debt by examining your income relative to your existing debts and the requested credit limit. A higher income relative to debt typically leads to better offers.

The type of credit you’re applying for influences the credit limit. For example, credit cards often have lower initial limits than loans, especially secured loans that use collateral.

Finally, the lender’s own policies and risk assessment models play a part. Different lenders have varying criteria and algorithms for determining credit limits, leading to different outcomes for the same applicant.

How Credit Scores Play a Role

Your credit score is a crucial factor in determining your credit limit. Lenders use it as a primary indicator of your creditworthiness and repayment ability. A higher credit score signifies a lower risk to the lender, leading to more favorable credit limit offers.

Credit scoring models, like FICO and VantageScore, analyze various aspects of your credit history to generate a numerical score. These factors include your payment history (on-time payments are critical), amounts owed (utilization rate is significant), length of credit history, new credit applications, and credit mix (variety of credit accounts is beneficial).

A high credit score (generally above 700) typically results in higher credit limits and more favorable interest rates. Lenders are more confident in lending larger sums to individuals with a proven track record of responsible credit management. Conversely, a low credit score (below 670) can severely limit your credit limit options or even result in credit applications being denied.

It’s important to note that while a high credit score significantly improves your chances of obtaining a high credit limit, it is not the sole determining factor. Other factors, such as your income, employment history, and the type of credit card applied for, also play a significant role.

Maintaining a strong credit score is essential for securing favorable credit terms. Regularly checking your credit report and addressing any inaccuracies is crucial for maximizing your credit limit potential.

Income and Existing Debts Matter

Your income is a crucial factor in determining your credit limit. Lenders assess your ability to repay the credit they extend. A higher, stable income demonstrates a greater capacity to manage debt, leading to a potentially higher credit limit.

Conversely, a low income or inconsistent employment history might result in a lower credit limit or even credit denial. Lenders want assurance that you can comfortably make your monthly payments without incurring further financial strain.

Your existing debt significantly impacts your credit limit. Lenders calculate your debt-to-income ratio (DTI), comparing your monthly debt payments to your gross monthly income. A high DTI suggests a greater financial burden, potentially leading to a lower credit limit or a higher interest rate.

The types of existing debts also matter. Having a variety of debts, such as credit cards, loans, and mortgages, might negatively impact your credit limit more than having only one type of debt. The number of open accounts and the amount of revolving credit used are also considered.

Responsible debt management, characterized by consistent on-time payments and low credit utilization, positively impacts your credit limit. Maintaining a good credit history demonstrates financial responsibility and increases your chances of securing a higher credit limit.

In summary, your income level and the amount and type of existing debt directly influence the credit limit offered by lenders. Demonstrating a stable income and responsible debt management practices significantly increases your chances of obtaining a favorable credit limit.

Why Limits May Change Automatically

Your credit limit isn’t necessarily a fixed number. Several factors can cause your credit limit to change automatically, often without direct action from you. These adjustments are usually made by the credit card issuer and are based on their internal risk assessment models.

One primary reason for automatic limit changes is your creditworthiness. As your credit score improves, reflecting responsible credit management such as on-time payments and low credit utilization, the issuer may perceive you as a lower risk and consequently increase your limit. This is a positive indicator of your financial health and trustworthiness.

Conversely, a decline in your credit score, perhaps due to missed payments or high utilization, may lead to a reduction in your credit limit. This is a protective measure taken by the issuer to mitigate potential losses. This should serve as a warning sign to review your spending habits and credit health.

Your payment history is another critical factor. Consistent on-time payments signal financial responsibility, making you a more attractive borrower. Conversely, missed or late payments can trigger a limit decrease. Regularly reviewing your credit report helps identify any potential issues.

The length of your credit history also plays a role. As your credit history grows and demonstrates a consistent pattern of responsible credit use, issuers may be more willing to increase your credit limit as a reward for long-term loyalty and financial stability.

Finally, changes in your income can also affect your credit limit. An increase in income may lead the issuer to believe you have a greater capacity to manage debt, potentially resulting in a limit increase. Conversely, a significant decrease in income could lead to a limit reduction.

When to Ask for an Increase

Knowing when to request a credit limit increase is crucial for maximizing your financial flexibility. It’s not simply a matter of wanting more credit; strategic timing is key to improving your chances of approval.

One ideal time is after demonstrating a history of responsible credit management. This means consistently paying your bills on time, keeping your credit utilization low (ideally below 30%), and maintaining a positive payment history for at least six months, and preferably a year or more.

A significant increase in your annual income can also strengthen your application. Providing documentation of this increase, such as a new employment letter or tax return, will demonstrate your improved ability to manage a higher credit limit responsibly.

Similarly, a considerable improvement in your credit score significantly boosts your chances. A higher score indicates a lower risk to the lender, increasing the likelihood of approval for a credit limit increase. Consider monitoring your credit report regularly to track your progress.

It’s also important to consider the purpose of the increase. Clearly articulating your need for a higher credit limit — such as for a large purchase or to manage business expenses — can help strengthen your request.

Finally, timing your request around an annual review period or after a period of consistently strong performance can improve your chances of success. Avoid requesting increases during times of financial instability or immediately after applying for other credit products.

How Limits Affect Utilization Ratio

Understanding how credit limits affect your utilization ratio is crucial for maintaining a healthy credit score. Your credit utilization ratio is calculated by dividing your total credit card debt by your total available credit. For example, if you have $1,000 in credit card debt and a $10,000 credit limit, your utilization ratio is 10% ($1,000/$10,000).

A lower utilization ratio is generally better for your credit score. Lenders prefer to see borrowers using a smaller percentage of their available credit. A ratio below 30% is typically considered good, while a ratio below 10% is considered excellent. Higher utilization ratios (above 30%) can negatively impact your credit score because they signal to lenders that you might be struggling to manage your debt.

Your credit limit directly influences your utilization ratio. A higher credit limit allows you to carry more debt before reaching a high utilization ratio. For instance, if your debt remains at $1,000 but your credit limit increases to $20,000, your utilization ratio drops to 5%, significantly improving your credit standing. Conversely, a lower credit limit means you’ll reach a high utilization ratio more quickly, even with a relatively small amount of debt.

Therefore, strategically managing your credit limit is key to maintaining a healthy utilization ratio. While increasing your credit limit can temporarily lower your utilization ratio, it’s important to manage your spending responsibly to avoid accumulating more debt. Focus on paying down your existing debt to further reduce your utilization ratio, regardless of your credit limit.

It’s also important to note that the number of credit accounts you have can impact your utilization ratio. Having multiple credit cards with lower individual limits can contribute to a higher overall utilization ratio, even if your total available credit is substantial. Responsible credit card usage and a focus on keeping balances low across all accounts is vital for optimal credit health.