Are you tired of struggling to make ends meet? Do you dream of financial freedom but feel overwhelmed by the sheer number of saving tips out there? Many money-saving strategies promise quick riches, but often fail to deliver lasting results. This article cuts through the noise, providing you with practical, actionable saving tips that will actually stick, helping you build a strong financial foundation and achieve your long-term financial goals. We’ll explore effective techniques to manage your budget, reduce unnecessary expenses, and cultivate lasting saving habits.

Discover proven strategies for saving money that go beyond simple budgeting apps. We’ll delve into the psychology of saving, identifying common pitfalls and offering solutions to overcome them. Learn how to prioritize your financial needs, set realistic saving goals, and track your progress effectively. This isn’t just about cutting back; it’s about building a sustainable financial plan that empowers you to take control of your finances and secure a brighter financial future. Prepare to transform your relationship with money and unlock the power of consistent savings.

Start With Small, Repeatable Steps

Consistency is key when it comes to saving money. Instead of aiming for drastic changes that are difficult to maintain, focus on incorporating small, manageable actions into your daily routine. These small wins add up over time and build momentum.

For example, instead of vowing to drastically cut your spending, start by identifying one small area where you can easily reduce expenses. This could be something as simple as bringing your lunch to work instead of eating out, brewing coffee at home, or foregoing daily lattes. These seemingly insignificant savings accumulate significantly over a month or year.

Another effective strategy is to automate your savings. Set up automatic transfers from your checking account to a savings account each payday. Even a small amount, such as $25 or $50, automatically saved each month will create a consistent savings habit.

The power of these small, repeatable steps lies in their sustainability. By making gradual changes, you’re less likely to experience overwhelm and more likely to stick to your savings plan long-term. These actions create a positive feedback loop, reinforcing the habit and encouraging you to build upon your success.

Remember, small consistent actions are far more effective than sporadic bursts of intense saving that are unsustainable. Start small, build momentum, and watch your savings grow.

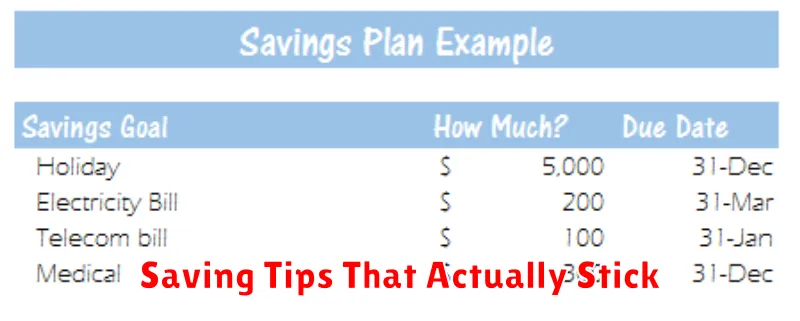

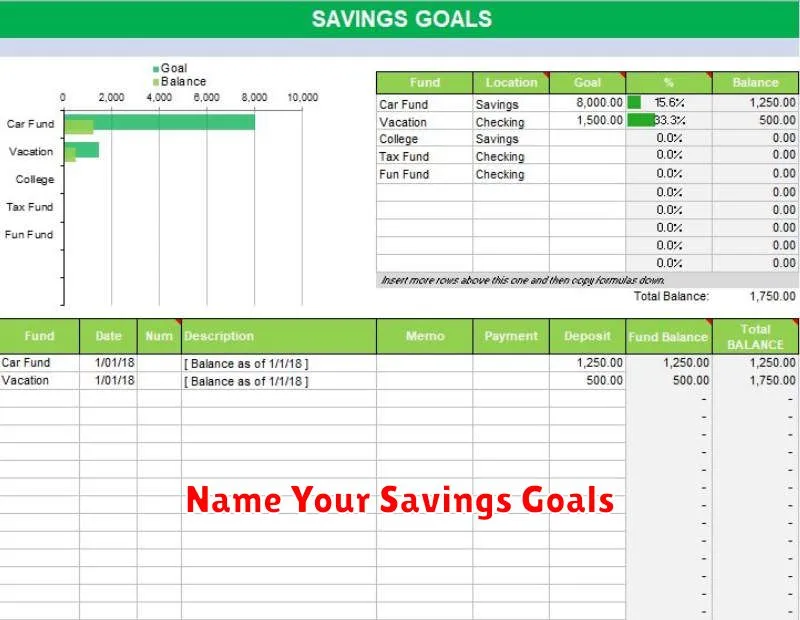

Name Your Savings Goals

Giving your savings goals specific names is a surprisingly effective strategy. Instead of vaguely aiming for “emergency fund” or “down payment,” try something more evocative and personal. For example, “Bali Trip Fund,” “New Car Fund,” or “Debt Freedom Fund” can inject more motivation and make the process feel more tangible.

The power of naming lies in its ability to personalize your financial goals. A name that resonates with you—a dream vacation, a desired purchase, or a significant life event—will serve as a constant reminder of why you’re saving and help you stay focused on the ultimate reward. This emotional connection can be a significant driver in maintaining consistent saving habits.

Consider creating a visual representation of your named savings goals. You could write them on a whiteboard, use sticky notes on a mirror, or create a spreadsheet with clear progress indicators. The key is to make the names visible and easily accessible, ensuring they’re regularly at the forefront of your mind.

Remember, the more meaningful the name, the stronger your commitment will be. Choosing a name that truly speaks to your aspirations will dramatically improve your chances of achieving your savings objectives.

Make Saving Automatic

One of the most effective ways to build a robust savings plan is to automate the process. This eliminates the need for consistent willpower and ensures regular contributions, regardless of your daily schedule or fluctuating income.

Many banks and financial institutions offer automatic transfer services. You can set up recurring transfers from your checking account to a savings account, ideally on payday. This allows you to save before you spend, significantly reducing the temptation to spend the money.

Consider setting up automatic transfers to multiple savings accounts if you have various saving goals. You could allocate a certain amount each month to an emergency fund, another to retirement, and perhaps a third to a vacation fund. This system helps you stay organized and track your progress towards specific financial goals.

The amount you automatically transfer should be manageable yet effective. Start small if needed, and gradually increase the amount over time as your income grows or your financial situation improves. The key is to create a habit and make saving a consistent part of your financial routine. The automatic nature of the system ensures that you consistently put money aside, regardless of your financial mood on a particular day.

Beyond traditional savings accounts, consider setting up automatic investments into a retirement plan like a 401(k) or IRA. Many employers offer matching contributions, essentially giving you free money. Automatically contributing to these accounts makes the most of this opportunity and builds substantial savings over time.

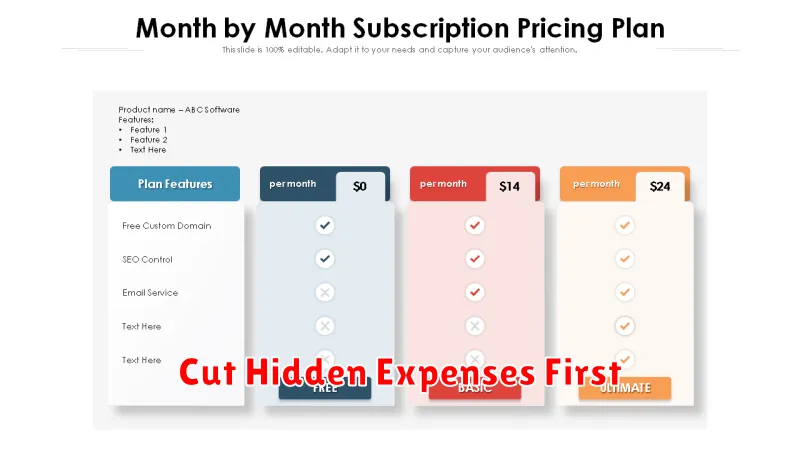

Cut Hidden Expenses First

Before tackling large, obvious expenses like housing or transportation, focus on identifying and eliminating hidden costs. These are the smaller, often overlooked expenditures that accumulate over time and significantly impact your budget. Many people are surprised by how much these seemingly insignificant amounts add up.

Start by carefully reviewing your bank and credit card statements for the past few months. Look for recurring charges you may have forgotten about, such as subscriptions you no longer use, gym memberships you don’t attend, or automatic payments for services you’ve cancelled. Consider using budgeting apps or spreadsheets to categorize your spending and visualize where your money is actually going.

Common hidden expenses include things like streaming services (you may only use one or two, but are paying for several), convenience fees for online purchases or bill payments, and impulse buys like coffee or snacks. Even small amounts spent daily can quickly add up to a substantial sum over a year. By carefully examining your spending habits and eliminating unnecessary expenses, you can free up a considerable amount of money for savings.

Another often overlooked area is subscriptions. Many people subscribe to multiple services, some of which may be used rarely or not at all. Actively assess your subscriptions and cancel those that are no longer necessary. This can lead to significant monthly savings without impacting your lifestyle drastically.

By focusing on eliminating these hidden expenses first, you’ll gain momentum and build confidence in your saving goals. This approach often makes the task of saving feel less daunting, encouraging continued effort and paving the way for larger savings achievements down the line.

Use a Visual Progress Tracker

One of the most effective ways to stay motivated and on track with your savings goals is to use a visual progress tracker. Seeing your progress visually can be incredibly motivating, providing a tangible representation of your achievements.

There are many ways to create a visual tracker. You could use a simple spreadsheet with a chart illustrating your savings over time, or opt for a more creative approach like a savings jar where you physically see the money accumulating. Consider a progress bar on a dedicated savings app, or even a handwritten chart on a whiteboard.

The key is to choose a method that you find engaging and easy to update regularly. The act of physically marking your progress, whether it’s adding coins to a jar or filling in a bar on a chart, reinforces your commitment and makes saving feel less abstract. This tangible representation helps combat feelings of discouragement and keeps you focused on your financial objectives.

Regularly reviewing your visual tracker will not only show your progress but also help identify areas where you might be falling short. This increased awareness allows you to make necessary adjustments to your saving strategy, ensuring you remain on the path to achieving your financial goals.

Celebrate Milestones Without Overspending

Celebrating life’s milestones is important, but it doesn’t require breaking the bank. Many people feel pressured to host extravagant parties or purchase expensive gifts, leading to unnecessary debt. However, meaningful celebrations can be achieved with a focus on budgeting and creativity.

Start by setting a realistic budget. Before planning anything, determine how much you’re comfortable spending. This helps avoid impulsive purchases and keeps spending in check. Consider what aspects of the celebration are most important to you and prioritize those.

Get creative with your celebrations. Instead of a large, expensive party, consider a smaller, more intimate gathering. A potluck dinner, a picnic in the park, or a backyard barbecue are all excellent options that minimize costs. Focus on the quality of time spent with loved ones rather than the extravagance of the event.

DIY decorations and homemade treats are another great way to save money. Not only are they often cheaper, but they add a personal touch that mass-produced items lack. Involve friends and family in the preparations; it can be a fun and bonding experience.

Utilize free resources. Many communities offer free or low-cost activities, such as parks, hiking trails, and community events. Take advantage of these resources to create memorable experiences without spending a fortune.

Consider experiences over material gifts. Instead of focusing on expensive presents, think about shared experiences like a weekend getaway, a cooking class, or a concert. These create lasting memories that are more valuable than material possessions.

Remember, the true value of a milestone celebration lies in sharing joy and creating memories with loved ones. By focusing on meaningful connections and clever planning, you can celebrate life’s important moments without overspending and maintain a healthy financial state.