Are you ready to take control of your financial future? Quarterly financial reviews are a powerful tool for achieving your financial goals, whether it’s saving for a down payment, paying off debt, or simply understanding where your money is going. This essential guide, “How to Review Your Finances Quarterly,” provides a structured approach to analyzing your income, expenses, and net worth, empowering you to make informed decisions and stay on track. Learn actionable steps to improve your financial health and build a stronger financial foundation.

Don’t let your finances become a mystery. By implementing a simple quarterly financial review process, you’ll gain valuable insights into your spending habits, identify areas for improvement, and proactively adjust your budget. This proactive approach to personal finance allows for early detection of potential problems, preventing them from spiraling out of control. Discover the benefits of consistent financial tracking and budgeting, and learn how to maximize your savings and achieve your financial aspirations through effective quarterly assessments. This article will provide you with clear, practical steps to make quarterly financial reviews an integral part of your financial management strategy.

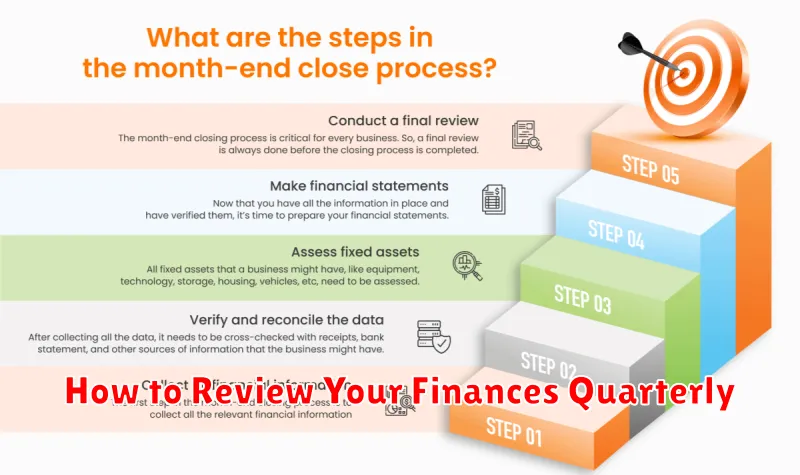

Why a 3-Month Review Is Important

Regularly reviewing your finances is crucial for maintaining financial health and achieving your financial goals. While annual reviews offer a broad overview, a quarterly, or three-month, review provides a more granular perspective, allowing for timely adjustments and proactive problem-solving.

A 3-month review allows you to track progress towards your short-term and long-term financial objectives. You can assess whether your spending habits align with your budget and identify any areas where you might be overspending. This early detection enables you to make necessary corrections before minor issues escalate into significant problems.

Furthermore, a quarterly review facilitates better budgeting practices. By analyzing your spending patterns over a shorter period, you can gain a clearer understanding of your cash flow and make informed decisions regarding your financial priorities. This enables you to allocate resources more effectively and avoid potential financial surprises.

Beyond budgeting, a 3-month review provides an opportunity to evaluate the performance of your investments. This allows you to make timely adjustments to your investment strategy based on market fluctuations and your evolving financial circumstances. It aids in risk management and ensures your investment portfolio aligns with your risk tolerance.

Finally, a 3-month review simply reinforces good financial habits. The act of regularly analyzing your finances keeps you mindful of your spending and saving, fostering a sense of responsibility and control over your financial well-being. This consistent monitoring greatly improves your overall financial literacy and decision-making.

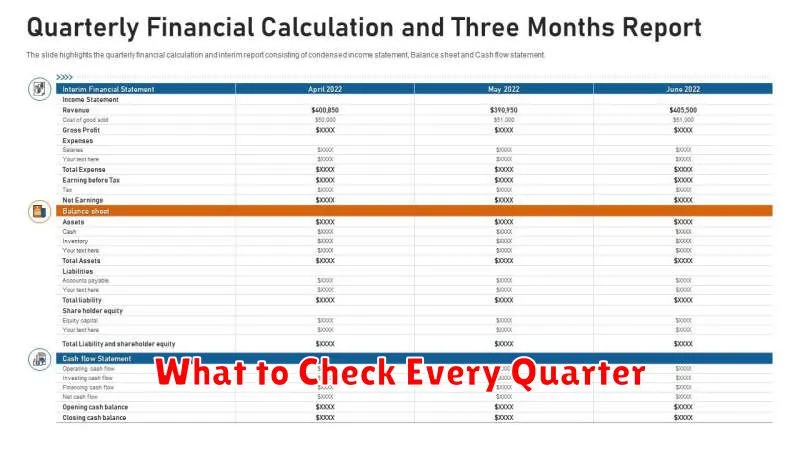

What to Check Every Quarter

A quarterly financial review is crucial for maintaining financial health and achieving your financial goals. It allows you to identify potential issues early and make necessary adjustments to your budget and spending habits.

Income: Begin by reviewing your income for the past three months. Compare it to your budgeted income and analyze any discrepancies. This will help you understand whether your income is consistent and if you need to adjust your budget based on any changes.

Expenses: A thorough examination of your expenses is paramount. Categorize your spending to pinpoint areas where you might be overspending. Consider using budgeting apps or spreadsheets to track your expenses effectively. Look for opportunities to reduce unnecessary spending.

Savings and Investments: Assess your progress toward your savings goals. Are you on track to meet your targets? Review your investment portfolio’s performance and make necessary rebalancing adjustments. Check for any fees or changes in investment strategies that may affect your returns.

Debt: Monitor your debt levels. Check your credit card balances, loan payments, and other outstanding debts. Look for ways to accelerate debt repayment or consolidate high-interest debts to lower your overall debt burden and save on interest.

Net Worth: Calculate your net worth by subtracting your liabilities (debts) from your assets (savings, investments, property). Tracking your net worth quarterly allows you to monitor your overall financial progress and identify any areas needing improvement. This provides a holistic view of your financial situation.

Tracking Net Worth Progress

Regularly reviewing your finances, such as quarterly, provides valuable insights into your financial health. A key component of this review is tracking your net worth progress. This involves calculating the difference between your assets (what you own) and your liabilities (what you owe).

To effectively track your net worth, create a simple spreadsheet or use personal finance software. List all your assets, including cash, investments (stocks, bonds, retirement accounts), real estate, and other valuable possessions. Then, list all your liabilities, such as credit card debt, loans (student loans, mortgages, auto loans), and any other outstanding balances.

Calculate your net worth by subtracting your total liabilities from your total assets. Record this figure and repeat the process each quarter. Comparing these figures over time allows you to monitor your financial growth and identify areas needing attention. A consistent upward trend indicates positive progress, while a decline may signal the need for adjustments in your spending or saving habits.

Consider also tracking the components of your net worth separately. This will allow you to see which areas are contributing most significantly to your overall growth or decline. For example, you might track the performance of your investment portfolio independently from your real estate holdings. This granular view offers a more complete understanding of your financial standing.

By diligently tracking your net worth quarterly, you gain a clear picture of your financial journey. This data helps inform financial decision-making, allowing you to make necessary adjustments to achieve your long-term financial goals.

Spotting Budget or Spending Trends

Regularly reviewing your finances, ideally on a quarterly basis, allows you to identify budget or spending trends that might otherwise go unnoticed. This proactive approach is crucial for maintaining financial health and achieving your financial goals.

Start by gathering your financial statements for the past three months. This includes bank statements, credit card statements, and any other records of income and expenses. Categorize your spending. Common categories include housing, transportation, food, entertainment, and debt payments. A spreadsheet or budgeting app can greatly simplify this process.

Once categorized, analyze the data to pinpoint spending patterns. Are there areas where you consistently overspend? Are there unexpected expenses that regularly appear? Identifying these trends is the first step toward making informed adjustments to your budget. Consider using visual aids like charts or graphs to better understand your spending habits. For instance, a bar chart can visually represent your spending across different categories, highlighting areas of potential concern.

Pay close attention to unusual spikes in spending. These could signal unexpected expenses or potential areas for improvement. For example, a significant increase in dining out might indicate a need to reduce restaurant visits or plan meals more effectively. Similarly, an unexpected rise in online shopping expenses might warrant a reassessment of your shopping habits and the implementation of strategies to curtail impulse purchases.

Comparing your current spending to previous quarters provides valuable context. Note any significant changes and reflect on the underlying reasons. This comparison reveals whether your spending is consistent, increasing, or decreasing over time. This longitudinal view provides a more comprehensive picture than simply looking at a single quarter’s data.

By diligently tracking and analyzing your spending, you gain valuable insight into your financial behavior. This information is invaluable in creating a more accurate and effective budget for the future. The key is to be objective and honest with yourself about your spending habits, allowing for realistic adjustments.

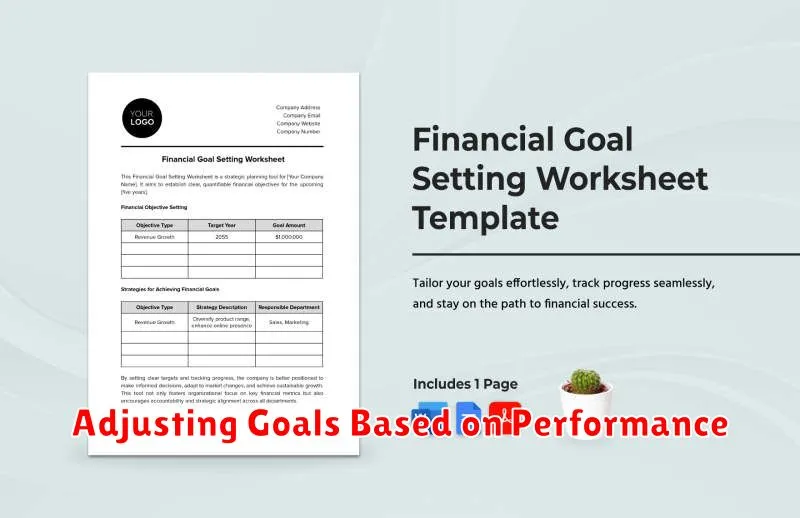

Adjusting Goals Based on Performance

A crucial aspect of quarterly financial reviews is evaluating your progress towards your financial goals. Did you meet your savings targets? Did your investments perform as expected? Honest self-assessment is paramount.

If you’ve significantly exceeded your goals, you might consider increasing your savings contributions, investing more aggressively, or setting new, more ambitious targets. This could involve accelerating your timeline for large purchases like a house or accelerating debt reduction.

Conversely, if you’ve fallen short of your goals, it’s time for a deeper dive. Analyze the reasons for the shortfall. Was it due to unexpected expenses? Changes in income? Underperformance of investments? Once identified, you can adjust your spending habits, explore alternative investment strategies, or re-evaluate the feasibility of your goals.

Flexibility is key. Rigid adherence to a plan without considering performance is counterproductive. Adjusting your goals based on your progress allows you to stay on track and adapt to changing circumstances. This might involve lowering your savings goals temporarily, prioritizing certain debts over others, or revising your investment strategy.

Remember to document your adjustments. Keeping a record of your original goals, your performance, and the subsequent changes you made will allow you to monitor your progress over time and improve your financial planning for future quarters.

Using Review Data for Planning

Once you’ve completed your quarterly financial review, the gathered data becomes an invaluable tool for future planning. Analyzing trends and patterns identified during your review allows you to make more informed decisions about your financial goals.

For example, if your review reveals consistent overspending in a particular category, you can adjust your budget for the next quarter to allocate funds more effectively. Perhaps you’ll set a stricter spending limit or explore alternative, more cost-effective options.

Similarly, if your review highlights consistent savings above your target, you might consider accelerating your progress towards a specific financial goal, like paying down debt faster or increasing investments.

The data from your review can also inform bigger-picture planning. Identifying periods of high expenditure can help you anticipate similar expenses in the future and proactively save for them. For instance, if you consistently spend more during the holiday season, planning ahead can prevent unexpected financial strain.

By proactively using your review data, you can create a proactive financial strategy. Rather than reacting to unexpected financial situations, you can anticipate them and prepare accordingly, leading to improved financial health and a greater sense of control over your finances.

Remember, the key is to use the data objectively. Avoid emotional reactions and focus on analyzing the numbers to gain actionable insights. This approach will allow you to refine your financial strategies and achieve your long-term financial objectives.