Embark on a transformative journey with the power of no-spend challenges. Discover how embracing a temporary period of financial abstinence can lead to remarkable personal growth and substantial savings. This isn’t about deprivation; it’s about reclaiming control over your finances and fostering a healthier relationship with money. Learn how a strategically planned no-spend month, or even a no-spend week, can provide clarity, reduce impulse purchases, and unlock your financial freedom. Uncover the surprising benefits beyond mere savings, including increased self-discipline and a heightened awareness of your spending habits.

This comprehensive guide delves into the practical strategies and psychological insights behind successful no-spend challenges. We’ll explore various no-spend challenge ideas to suit your individual needs and circumstances, from extreme no-spend challenges to more moderate approaches. We’ll also address common hurdles and provide actionable tips to overcome them, ensuring your no-spend month or no-spend challenge is not only achievable but also rewarding. Prepare to unlock the transformative power of no-spend and gain a newfound appreciation for mindful spending.

What Is a No-Spend Challenge?

A no-spend challenge is a period of time, ranging from a single day to several months, during which an individual commits to abstaining from all non-essential spending. The specific parameters of the challenge are entirely customizable and depend on the individual’s goals and financial situation.

The core principle revolves around deliberately limiting discretionary expenditures. This means focusing solely on essential expenses, such as rent or mortgage payments, utilities, groceries, transportation, and debt repayments. Any spending beyond these necessities is strictly prohibited.

While the specific definition of “essential” can vary, the overall aim remains consistent: to gain a heightened awareness of spending habits and to identify areas where money is being unnecessarily spent. Participants often use a budgeting app or a simple spreadsheet to meticulously track their spending and ensure compliance with the self-imposed restrictions.

Importantly, a no-spend challenge isn’t about deprivation; it’s about intentional spending. It’s an opportunity to re-evaluate one’s relationship with money, discover hidden savings potential, and cultivate mindful consumption practices. It encourages creativity in finding free or low-cost alternatives for entertainment and leisure activities.

The success of a no-spend challenge hinges on clear goals and realistic planning. Defining specific objectives, such as paying down debt or saving for a down payment, can provide the necessary motivation and structure to stay committed throughout the challenge. Proper preparation, including identifying potential temptations and developing coping strategies, is also crucial.

How to Set Rules and Duration

Successfully navigating a no-spend challenge hinges on establishing clear rules and a defined duration. Without these foundational elements, your attempt may falter due to ambiguity and a lack of focus.

When determining your rules, be specific. Avoid vague terms. Instead of “limiting spending,” specify what constitutes a “necessary” expense versus a “want.” For instance, grocery shopping for essential food items is permissible, while dining out or purchasing non-essential clothing is not. Consider outlining allowances for specific categories: perhaps a small weekly budget for incidentals or a set amount for gas. The key is to create guidelines that are achievable and sustainable for your lifestyle.

The duration of your challenge is equally crucial. A shorter challenge, like a 30-day no-spend month, provides a manageable commitment and a quick sense of accomplishment. Longer challenges, spanning several months, offer more significant savings but require greater discipline. Choose a duration that aligns with your goals and personal capabilities. A realistic timeframe is far more effective than an overly ambitious one that may lead to failure and discouragement.

Remember, the rules and duration are personal choices. There’s no single “right” way to approach a no-spend challenge. Experiment with different approaches to find a method that fits your individual circumstances and fosters lasting positive habits.

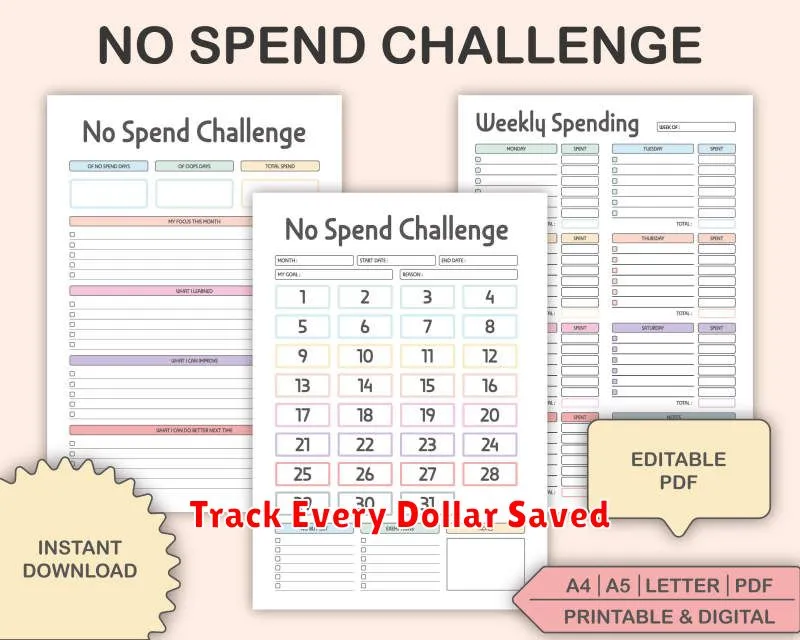

Track Every Dollar Saved

One of the most impactful aspects of a no-spend challenge is the tangible demonstration of your savings. This isn’t just about restricting spending; it’s about actively observing the positive financial impact of your choices. By meticulously tracking every dollar saved, you gain a profound understanding of your spending habits and the potential for financial growth.

There are several effective methods for tracking your savings. A simple spreadsheet can be incredibly useful, allowing you to categorize your savings and visualize your progress over time. Alternatively, dedicated budgeting apps offer features such as automated tracking, goal setting, and insightful reporting. The key is to choose a method that suits your personal preferences and technological comfort level.

The act of recording every saved dollar offers a powerful psychological reinforcement. Seeing the numbers accumulate provides a concrete sense of accomplishment and motivates you to continue your no-spend challenge. This visual representation transforms abstract concepts of saving into a clear and compelling reality, fostering a stronger commitment to financial discipline.

Furthermore, tracking your savings during a no-spend challenge lays a strong foundation for long-term financial management. The skills and habits you develop – budgeting, tracking, and mindful spending – are transferable beyond the challenge itself, enabling you to cultivate healthier financial practices for years to come. This newfound awareness empowers you to make more informed decisions, contributing to improved financial well-being.

Best Items to Cut Temporarily

Embarking on a no-spend challenge requires careful consideration of where to allocate your financial resources. Identifying areas for temporary reduction can significantly boost your savings and provide valuable insights into your spending habits. The key is to choose items that won’t drastically impact your well-being or daily functioning, but still represent a substantial portion of your expenditures.

One of the easiest categories to temporarily eliminate is eating out. Preparing meals at home is significantly cheaper and healthier. This includes coffee shop visits and takeout lunches. Packing your own lunch and brewing coffee at home can save a surprising amount of money over time. Consider tracking your current spending in this area to gauge the potential savings.

Another area ripe for temporary cuts is entertainment and leisure activities. This can encompass movie tickets, concerts, streaming subscriptions, and even gym memberships. Explore free alternatives such as hiking, visiting parks, or borrowing books from the library. Consider consolidating streaming services or temporarily canceling those you don’t use frequently.

Subscriptions are often overlooked yet represent a significant recurring expense. This includes magazine subscriptions, online services, and membership fees. Review your current subscriptions to identify those that are underutilized or no longer essential. Many services offer free trials or temporary pauses in billing, making it easy to test if you truly miss these services.

Impulse purchases represent a common pitfall for many. This category can encompass items purchased out of convenience, emotional spending, or simply lack of planning. To curb this, prioritize making shopping lists, tracking your purchases, and giving yourself time to consider a purchase before committing. Implementing a waiting period of 24-48 hours can significantly reduce impulse buying.

Finally, consider examining your non-essential personal care items. This could range from specialty coffees or teas to expensive hair products or makeup. Focusing on basic needs and using what you already have can result in surprising savings. Remember, the goal is temporary reduction, not deprivation. Evaluate your current spending and identify areas where a temporary pause will provide the biggest impact on your savings.

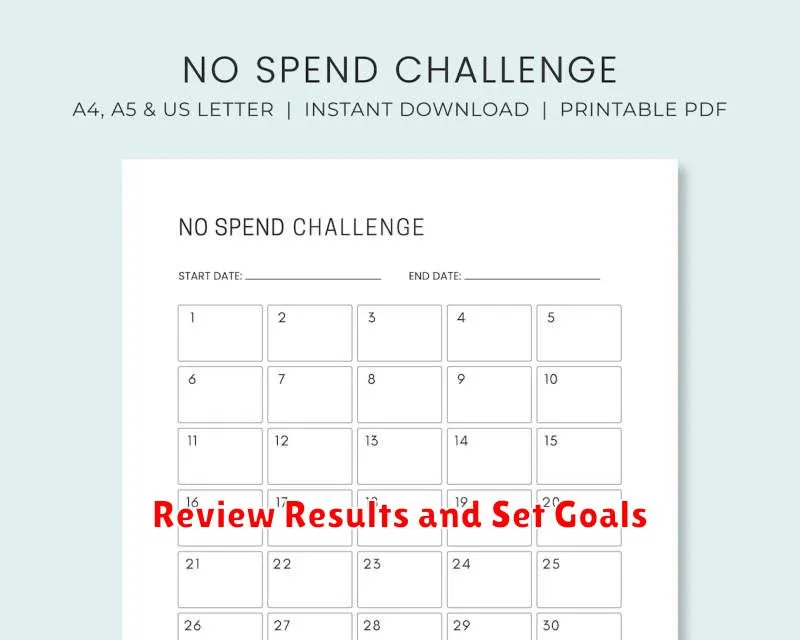

Review Results and Set Goals

After completing your no-spend challenge, take time to thoroughly review your results. This isn’t just about the monetary savings, although that’s a significant aspect. Analyze your spending habits before the challenge and compare them to your spending during the challenge period. Note any significant differences.

Consider what strategies worked best for you. Did you find certain budgeting apps particularly helpful? Did eliminating specific activities significantly reduce your spending? Identifying these successful strategies will help you refine your approach in future challenges.

Equally important is to acknowledge any challenges you faced. What tempted you to spend? Were there areas where you struggled to resist impulse buys? Understanding your weaknesses allows you to develop coping mechanisms and anticipate potential hurdles in future financial endeavors.

Based on your review, establish realistic and achievable goals for your future spending habits. These goals shouldn’t be overly restrictive, but they should reflect a conscious effort to maintain responsible spending habits. Consider setting both short-term (e.g., a month) and long-term (e.g., a year) goals.

Finally, remember that consistency is key. A no-spend challenge is a powerful tool, but its effectiveness relies on integrating its lessons into your long-term financial planning. The insights gained should inform your overall financial strategy, leading to improved savings and reduced debt.

Turn It Into a Regular Habit

The true power of no-spend challenges lies not just in the immediate financial benefits, but in their ability to cultivate lasting changes in spending habits. Successfully completing a challenge is a significant achievement, but to truly maximize its impact, you must integrate its principles into your regular routine.

Consider incorporating regular reflection periods. Perhaps once a week, review your spending habits. Identify areas where you could have made better choices and celebrate your successes. This consistent self-assessment will strengthen your resolve and build your awareness of your spending triggers.

Budgeting is crucial for sustained success. While a no-spend challenge may temporarily restrict spending, a well-structured budget provides a long-term framework for financial control. Develop a budget that aligns with your values and financial goals, ensuring that you can consistently allocate resources while still enjoying life’s pleasures.

Mindful spending is another key element. Before making any purchase, ask yourself if it truly aligns with your needs and values. This pause for reflection prevents impulsive buys and reinforces the habits cultivated during the challenge. Learning to differentiate between wants and needs is a powerful tool for long-term financial stability.

Finally, reward yourself appropriately. While the primary reward is improved financial health, incorporating small, non-monetary rewards can help sustain motivation. This could include enjoying a free activity like a hike in nature or spending quality time with loved ones, reinforcing positive habits without resorting to spending.