Managing irregular income can be a significant challenge, but with the right strategies, you can achieve financial stability and security. This article will guide you through practical steps to effectively budget, save, and invest when your income fluctuates. We’ll explore techniques for tracking income and expenses, building an emergency fund, and creating a flexible budget tailored to your unpredictable cash flow. Learn how to navigate the complexities of irregular paychecks and achieve your financial goals despite the uncertainty.

Whether you’re a freelancer, self-employed individual, gig worker, or simply dealing with unpredictable income streams, understanding how to manage your finances is crucial. This comprehensive guide provides actionable advice on minimizing debt, planning for taxes, and securing your financial future. Discover effective money management strategies specifically designed for those facing the unique financial realities of irregular income. Gain the confidence to take control of your financial life and build a secure future.

What Is Irregular Income?

Irregular income, also known as inconsistent or variable income, refers to earnings that are not received at a consistent rate or amount over time. Unlike a regular salary or fixed wages, irregular income fluctuates from period to period, making it challenging to predict and budget for future expenses.

This type of income is common among self-employed individuals, such as freelancers, independent contractors, and gig workers. It can also apply to those with part-time jobs, seasonal employment, or commission-based roles where earnings depend directly on sales or performance.

Key characteristics of irregular income include unpredictable pay periods, varying amounts earned each month or pay period, and a lack of consistent financial stability. This variability presents significant challenges when it comes to managing personal finances and planning for the long term.

Examples of sources of irregular income include: freelancing projects, contract work, tips and commissions, dividends from investments (that fluctuate), and rental income (that can vary based on occupancy).

Understanding the nature of irregular income is crucial for developing effective budgeting and financial management strategies. It requires a different approach compared to managing a stable, predictable income stream.

Track Your Minimum Monthly Needs

Managing irregular income requires a proactive approach to budgeting. The first crucial step is to meticulously track your minimum monthly needs. This involves identifying and documenting all your essential expenses.

Create a detailed list encompassing housing (rent or mortgage payment), utilities (electricity, water, gas), groceries, transportation (fuel, public transport), healthcare (insurance premiums, medication), and debt repayments (minimum payments on loans or credit cards). Don’t forget to include other essential items like personal care products and communication expenses (phone and internet).

For accuracy, review your past bank statements and credit card bills for at least three months. This provides a more comprehensive understanding of your typical spending patterns. Categorize each expense meticulously to gain a clear picture of where your money is going. Consider using a budgeting app or a spreadsheet to streamline this process.

Once you have a clear understanding of your essential monthly expenditures, you can begin to develop a realistic budget that accounts for the variability of your income. This foundational step is critical to effectively managing your finances when your income fluctuates.

Remember, this exercise focuses solely on minimum needs. Non-essential expenses should be addressed later, once you have established a firm grasp on managing your essential costs. This initial focus allows you to build a strong financial foundation even with inconsistent income.

Use a Base Budget System

Managing finances with an irregular income requires a different approach than traditional budgeting. Instead of focusing on a fixed monthly income, a base budget system works best. This system centers around your essential expenses, creating a stable financial foundation regardless of income fluctuations.

Start by listing all your essential expenses. These are the non-negotiable costs required for survival and well-being, such as housing, utilities, groceries, transportation, and debt payments (minimum payments). Calculate the total of these essential costs to establish your base budget amount.

Next, prioritize covering your base budget each month. This ensures you meet your fundamental needs, preventing financial distress during periods of low income. You might need to adjust spending in other areas to ensure this happens, but your basic needs are always the priority.

Any income exceeding your base budget can then be allocated to savings, debt repayment (beyond minimum payments), discretionary spending, or investments. This flexible approach allows you to adjust your spending according to the income you receive, preventing overspending during high-income months and providing a buffer during low-income periods. Tracking your income and expenses meticulously will be crucial for this system to work effectively.

Remember to regularly review and adjust your base budget. Life circumstances change, and so should your budget. Regular review allows you to adapt to varying expenses and income levels, ensuring your base budget remains a practical and effective tool for managing your finances.

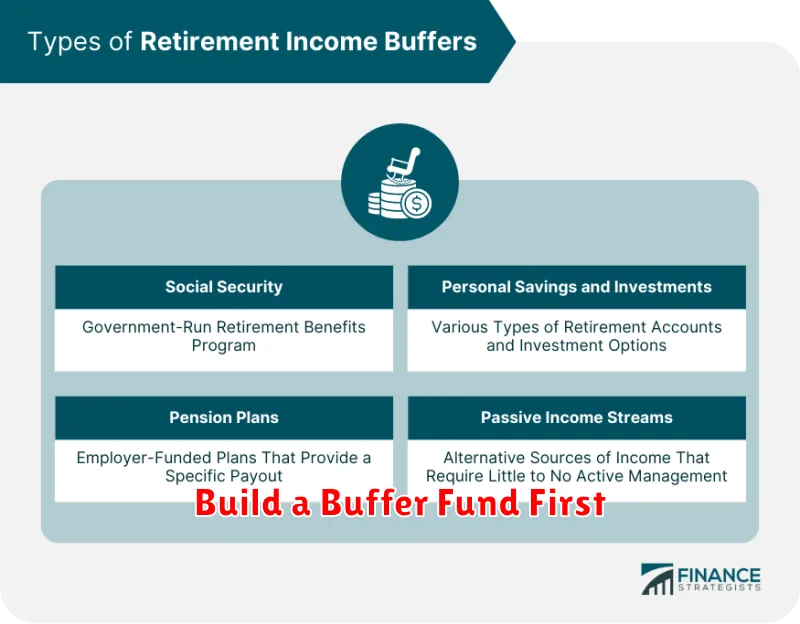

Build a Buffer Fund First

Managing finances with an irregular income presents unique challenges, but a buffer fund is your most crucial first step. This fund acts as a safety net, providing a cushion against unexpected expenses and periods of lower income. It allows you to avoid accumulating debt and maintain financial stability.

The size of your buffer fund depends on your individual circumstances and spending habits. A general guideline is to aim for three to six months’ worth of essential living expenses. This includes rent or mortgage payments, utilities, groceries, transportation, and any necessary debt repayments. The more irregular your income, the larger your buffer fund should ideally be.

Building this fund requires discipline and prioritization. Track your income and expenses meticulously to identify areas where you can save. Even small, consistent contributions can significantly impact your savings over time. Consider automating transfers to your savings account each time you receive payment, regardless of the amount.

While building your buffer fund, it’s essential to continue budgeting, even with fluctuating income. This helps you understand your spending patterns and identify potential areas to reduce costs. A budget also facilitates better control over your finances and helps you see how close you are to reaching your buffer fund goal.

Remember, this initial step of building a buffer fund is the foundation for effectively managing irregular income. Once established, you can begin to focus on longer-term financial goals, secure in the knowledge that you have a financial safety net in place to weather unexpected income fluctuations.

Pay Yourself a Set Salary

Managing irregular income can be challenging, but establishing a consistent salary is a crucial step towards financial stability. This means setting aside a predetermined amount from each income payment, regardless of its size. Think of this as paying yourself first.

Determine a realistic salary based on your average monthly expenses and financial goals. This amount should cover your essential needs, such as rent, utilities, groceries, and transportation. Consider adding a portion for savings and debt repayment, as well.

Once you’ve determined your salary, automate the transfer of funds. Set up automatic transfers from your checking account to a separate savings or investment account immediately after receiving income. This ensures consistent contributions, even during months with lower earnings.

It’s important to track your income and expenses meticulously. Maintaining a budget helps you adjust your salary as needed and ensures you stay on track with your financial goals. This is especially important with fluctuating income, allowing for adjustments during periods of higher or lower earnings.

Consistency is key. Even when income is low, prioritize paying yourself the established salary. This prevents impulsive spending and maintains financial discipline, paving the way for better long-term financial planning.

Plan for Tax and Off-Seasons

Managing irregular income requires a proactive approach to financial planning, especially when it comes to tax obligations and periods of low or no income (off-seasons).

Tax planning is crucial. Since your income fluctuates, you might not have a consistent amount withheld for taxes throughout the year. To avoid a large tax bill at the end of the year or penalties for underpayment, consider making estimated tax payments quarterly. Consult a tax professional to determine the appropriate amount to pay based on your projected income.

During off-seasons, when income is low or nonexistent, careful budgeting is essential. Create a realistic budget that accounts for your essential expenses and minimizes non-essential spending. Consider building an emergency fund to cover expenses during these periods. This fund should ideally cover at least three to six months’ worth of living expenses.

Tracking your income and expenses meticulously is key. Utilize budgeting apps or spreadsheets to monitor your cash flow throughout the year. This will provide valuable insights into your spending habits and help you identify areas where you can save during high-income periods to buffer against leaner times.

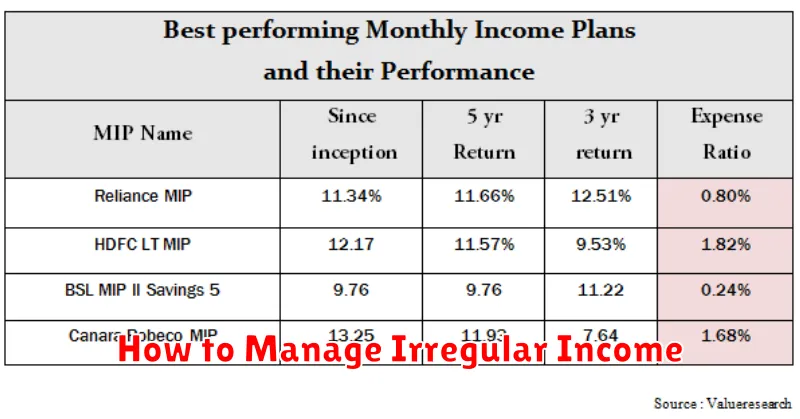

Exploring options like short-term savings accounts or high-yield savings accounts can help maximize the returns on your savings during off-seasons, allowing your money to work for you while you wait for your income to pick up again. It is important to weigh the risk associated with higher-yield options to your financial goals and comfort level.

Finally, consider diversifying your income streams to mitigate the impact of income fluctuations. Explore additional income sources to supplement your primary income, particularly during off-seasons. This could involve freelancing, part-time jobs, or investments, helping to stabilize your overall financial situation.