Establishing a robust financial routine is crucial for achieving your long-term financial goals. Whether you’re aiming for early retirement, a down payment on a house, or simply greater financial security, a well-structured plan is paramount. This article will guide you through creating a personalized financial routine that works for you, covering essential aspects like budgeting, saving, investing, and managing debt. Learn how to take control of your finances and build a brighter financial future.

Many struggle with financial planning, feeling overwhelmed by the complexity or lacking the necessary knowledge. However, developing a sustainable financial routine doesn’t have to be daunting. We’ll break down the process into manageable steps, offering practical strategies and proven techniques to help you create a personalized financial roadmap. This article will empower you to build good financial habits, leading to improved financial wellness and a more secure future. Discover how smart financial decisions can transform your life.

What Is a Financial Routine?

A financial routine is a systematic and consistent approach to managing your personal finances. It encompasses all aspects of your financial life, from earning and saving to spending and investing. This isn’t about rigid rules, but rather about establishing healthy habits that empower you to make informed decisions and achieve your financial goals.

Unlike sporadic attempts at budgeting or saving, a robust financial routine involves regularly scheduled activities. This could include reviewing your bank accounts weekly, paying bills on time, tracking expenses daily, and allocating funds for savings and investments monthly. The key is consistency – integrating these actions into your regular schedule, much like brushing your teeth or exercising.

A well-defined financial routine offers several benefits. It promotes financial awareness, allowing you to understand your spending habits and identify areas for improvement. It reduces financial stress by eliminating last-minute panics about bills or unexpected expenses. Ultimately, a strong routine contributes to long-term financial stability and the achievement of significant financial objectives such as retirement planning or homeownership.

The specific components of your financial routine will depend on your individual needs and circumstances. However, a well-structured routine typically involves aspects of budgeting, saving, investing, and debt management. It’s important to find a routine that works for you, allowing for flexibility while maintaining the core principle of consistency and regular action.

Daily, Weekly, Monthly Money Tasks

Establishing a financial routine requires consistent effort, broken down into manageable tasks across different timeframes. This approach ensures you stay on top of your finances without feeling overwhelmed.

Daily tasks focus on awareness and small actions that contribute to larger goals. Reviewing your spending for the day, even a quick glance at your digital transactions, provides insight into your spending habits. This simple act can help you identify areas for improvement and avoid impulse purchases. Another key daily task is to ensure your budgeting app (if you use one) is up-to-date.

Weekly tasks involve a more comprehensive overview. This is a good time to reconcile your bank statements and credit card transactions to ensure accuracy and catch any discrepancies early. Additionally, schedule time to review your progress toward your financial goals. Are you on track with saving for a down payment? Have you reached your monthly savings target?

Monthly tasks require more substantial time commitment and often involve bill payments and longer-term financial planning. Pay all your bills on time to avoid late fees and maintain a good credit score. This is also an excellent time to review your budget, making necessary adjustments based on your spending habits and income. For example, consider allocating excess funds towards investments or paying down high-interest debts.

How to Automate and Simplify

Establishing a robust financial routine often feels overwhelming. The sheer volume of tasks – budgeting, bill paying, investing, tracking expenses – can quickly become daunting. Fortunately, automation can significantly simplify the process and free up valuable time and mental energy.

One of the most effective ways to automate your finances is by utilizing direct debit and autopay features offered by your bank and various service providers. Setting up automatic payments for recurring bills like rent, utilities, and subscriptions eliminates the risk of late payments and associated fees. This automated system ensures consistent and timely payments, reducing stress and freeing you from manual tracking.

Beyond bill payments, consider automating your savings. Many banks and investment platforms offer automated transfer options, allowing you to regularly allocate a specific amount from your checking account to your savings or investment accounts. This consistent contribution, often referred to as dollar-cost averaging, is a powerful tool for building wealth over time without requiring active management.

Furthermore, budgeting apps and personal finance software can significantly streamline the process of tracking your income and expenses. These tools often incorporate features like automated categorization of transactions, allowing for easy visualization of your spending habits and identification of potential areas for improvement. Employing these technologies empowers you to make informed financial decisions and gain a clear picture of your financial health.

Finally, remember to regularly review and adjust your automated systems. Life circumstances change, and your financial needs will evolve. Periodically checking your automated payments and savings plans ensures they remain aligned with your current goals and financial situation, preventing any unforeseen issues.

Tracking Progress Over Time

Establishing a financial routine requires more than just setting a budget; it necessitates consistent monitoring to ensure its effectiveness. Tracking your progress over time is crucial for identifying areas needing improvement and celebrating successes along the way.

Regularly review your budget versus actual spending. This could be a weekly, bi-weekly, or monthly process depending on your preferences and the complexity of your financial situation. Note any discrepancies and analyze the reasons behind them. This process allows for timely adjustments to your spending habits, preventing larger issues down the line.

Consider using a budgeting app or spreadsheet to automate the tracking process. These tools often provide visual representations of your spending, making it easier to identify trends and potential areas for savings. Many offer features to categorize spending, making it simple to see where your money is going.

Beyond tracking spending, also monitor your progress towards financial goals. Whether you’re saving for a down payment on a house, paying off debt, or investing for retirement, regularly reviewing your progress reinforces your commitment and helps you stay motivated. Use visual aids, such as charts or graphs, to illustrate your progress over time.

Remember that consistency is key. Don’t get discouraged by occasional setbacks. The process of establishing a strong financial routine is a marathon, not a sprint. By consistently tracking your progress, you gain valuable insights, celebrate your achievements, and stay accountable throughout your journey.

Review and Adjust Each Month

A crucial element of any successful financial routine is regular review and adjustment. Don’t set it and forget it; your circumstances change, and your financial plan should adapt accordingly.

At the start of each month, dedicate some time – even just 30 minutes – to assess your progress. Review your budget to see where you’re exceeding or falling short of your goals. Were there any unexpected expenses? Did you save more than anticipated?

Analyze your spending habits. Identify areas where you can potentially cut back or make more efficient choices. Consider using budgeting apps or spreadsheets to track your spending automatically; these tools often provide valuable insights into your financial behavior.

Examine your investment portfolio (if applicable). Review your investment performance and consider rebalancing if necessary. Market fluctuations happen, and it’s important to maintain your target asset allocation.

Check your savings progress towards your short-term and long-term goals. Are you on track? If not, explore potential adjustments to your savings rate or spending habits to stay aligned with your objectives. Perhaps you can find some additional income opportunities to aid in accelerating this process.

Finally, review your debt. Are you making consistent payments? Are you making satisfactory progress in paying down your balances? If not, re-evaluate your debt repayment strategy to ensure you’re on the path to becoming debt-free.

This monthly review is not just about tracking numbers; it’s about cultivating a mindful approach to your finances. Regularly analyzing your financial health empowers you to make informed decisions and stay in control of your financial future.

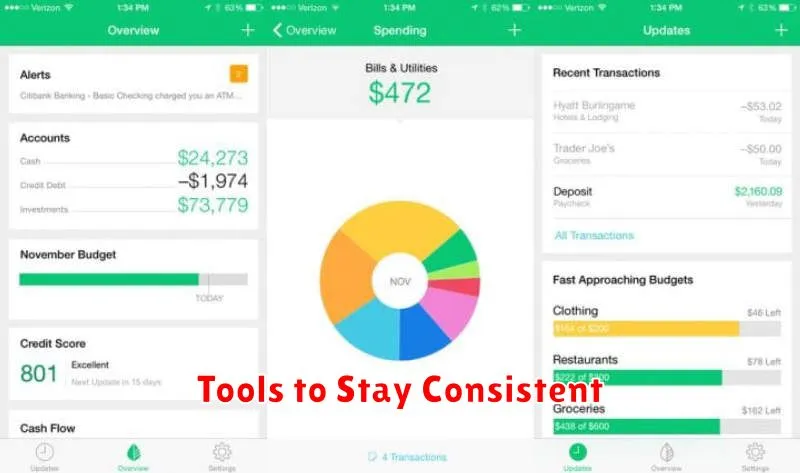

Tools to Stay Consistent

Establishing a financial routine requires more than just good intentions; it demands consistent action. Fortunately, several tools can significantly aid in maintaining your financial discipline and tracking your progress.

Budgeting apps are invaluable. These apps, available on most smartphones and computers, allow you to categorize expenses, track income, and visualize your spending habits. Many offer features like automatic transaction imports, bill reminders, and savings goal setting, making the process significantly less cumbersome.

Spreadsheet software provides a more hands-on approach to budgeting and financial planning. While requiring more manual input, spreadsheets offer greater flexibility and customization. You can create personalized formulas and charts to analyze your finances in detail and develop more complex financial models.

Beyond budgeting, consider utilizing financial management software. These comprehensive platforms often integrate budgeting, investment tracking, tax preparation assistance, and debt management tools into a single interface, offering a holistic view of your financial health.

Finally, don’t underestimate the power of simple notebooks and planners. The act of physically writing down your financial goals and tracking your progress can foster a stronger sense of accountability and motivation. The tactile nature of this method can be particularly effective for some individuals.