Are you overwhelmed by high-interest debt? Feeling trapped by credit card debt, personal loans, or medical bills? The debt avalanche method offers a strategic approach to paying off debt faster and saving money on interest. This proven method prioritizes paying off your highest-interest debt first, regardless of balance, allowing you to reduce your overall debt burden more efficiently than other strategies. Learn how the debt avalanche method can help you gain control of your finances and achieve financial freedom.

This comprehensive guide will walk you through the steps involved in implementing the debt avalanche method, including how to calculate your interest rates, create a realistic budget, and stay motivated throughout the process. We’ll also explore the benefits and drawbacks of this approach, comparing it to other popular debt repayment strategies, such as the debt snowball method. By understanding the debt avalanche method, you can make informed decisions about your financial future and embark on a journey towards a debt-free life.

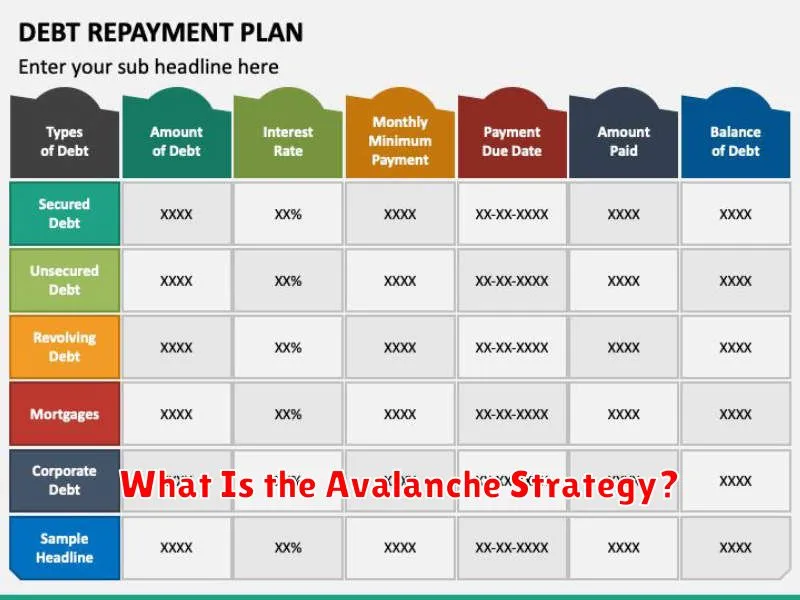

What Is the Avalanche Strategy?

The debt avalanche method is a popular debt repayment strategy that focuses on minimizing the total interest paid. Unlike the debt snowball method, which prioritizes paying off the smallest debts first for motivational purposes, the avalanche method targets the debt with the highest interest rate first.

This approach is mathematically advantageous because it tackles the debts that are costing you the most money the fastest. By prioritizing high-interest debt, you reduce the overall interest you pay over the life of your loans, ultimately saving you a significant amount of money.

The strategy involves making minimum payments on all other debts while allocating as much extra money as possible towards the debt with the highest interest rate. Once that debt is paid off, you then roll that payment amount into the next highest interest debt, continuing the process until all debts are eliminated. This creates a cascading effect, similar to an avalanche, hence the name.

While the initial progress might seem slower compared to the debt snowball method (because you might be tackling a larger debt first), the long-term financial benefits of the avalanche strategy are generally considered more substantial due to the significant reduction in total interest paid. It’s a financially sound approach for those prioritizing minimizing long-term costs.

Difference from Snowball Method

The debt avalanche method and the debt snowball method are both popular strategies for paying off multiple debts, but they differ significantly in their approach. The key distinction lies in how they prioritize which debts to tackle first.

The debt avalanche method prioritizes paying off debts with the highest interest rates first. This approach minimizes the total amount of interest paid over the life of the loans, leading to significant long-term savings. By focusing on high-interest debts, you effectively reduce the overall cost of borrowing and accelerate your debt-free journey.

Conversely, the debt snowball method focuses on paying off the smallest debts first, regardless of their interest rates. While this might mean paying more interest in the long run, the psychological benefit of quickly eliminating smaller debts provides powerful motivation. The sense of accomplishment from early wins can encourage consistent repayment and bolster determination to continue the process.

In essence, the debt avalanche method is the more mathematically sound approach, optimizing for financial efficiency. The debt snowball method, however, leverages psychological momentum to achieve the same end goal, albeit potentially at a higher overall cost.

Choosing between these methods depends heavily on individual preferences and financial circumstances. Some individuals find the immediate gratification of the snowball method more sustainable, while others prefer the long-term financial benefits offered by the avalanche method. Understanding the core differences allows for a more informed decision.

How to Prioritize by Interest Rate

The debt avalanche method prioritizes paying off debt based on the interest rate. This strategy focuses on tackling the debts with the highest interest rates first, regardless of the balance.

To effectively prioritize using this method, you’ll need to gather information on each of your debts. Make a list including the creditor, the current balance, and the annual percentage rate (APR). This APR is your interest rate. Some creditors might list this as a monthly rate; make sure to convert it to an annual rate for accurate comparison.

Once you have this information compiled, order your debts from highest interest rate to lowest. This becomes your repayment order. You will allocate your extra funds towards paying off the highest interest debt first, while making minimum payments on all other debts. Once the highest interest debt is paid off, you will take that amount of money and add it to the amount you’re already paying towards the debt with the next highest interest rate.

This snowballing effect is a key feature of the debt avalanche method. By focusing on high-interest debts, you minimize the total amount of interest paid over the life of your debts. This results in quicker debt reduction and significant cost savings in the long run compared to other methods.

Remember to continue making minimum payments on all debts while concentrating your extra resources on the prioritized debt. This ensures you avoid late payment fees and maintain a positive credit history.

Benefits of Paying Less Interest

One of the most significant advantages of employing debt repayment strategies like the debt avalanche method is the potential to pay significantly less interest over the life of your loans. Interest is essentially the cost of borrowing money, and the longer you take to repay your debts, the more interest you accumulate.

By prioritizing high-interest debts, as the debt avalanche method advocates, you can accelerate the repayment process. This directly translates to a reduction in the total amount of interest you’ll pay. The sooner you eliminate high-interest debts, the less they cost you in the long run.

Reducing interest payments leads to significant savings. These savings can then be redirected towards other financial goals, such as investing, building an emergency fund, or accelerating payments on remaining debts. This creates a positive feedback loop, accelerating your path towards financial freedom.

Furthermore, lowering your interest burden improves your overall financial health. A lower monthly payment on high-interest debts can significantly ease financial stress and improve your credit score, enabling access to better financial products in the future. This makes it easier to manage your finances and achieve your long-term financial goals.

Ultimately, the benefit of paying less interest through effective debt management strategies is multifaceted. It not only saves you money but also empowers you to take control of your finances, freeing up resources for other important life goals. This financial flexibility is a key advantage of prioritizing debt repayment.

How to Stay Motivated Long-Term

Paying down debt using the debt avalanche method, or any method for that matter, requires significant long-term commitment. Maintaining motivation throughout this process can be challenging, but it’s crucial for success. Here are some strategies to help you stay focused and reach your goal.

Set realistic goals. Don’t try to tackle everything at once. Start with small, achievable milestones. For example, focus on paying off one small debt completely before moving to larger ones. The satisfaction of achieving these small wins will fuel your motivation.

Visualize your success. Imagine the feeling of being debt-free. Create a vision board or write down your goals and how achieving them will improve your life. This visualization will keep you motivated when times get tough.

Track your progress. Regularly monitor your progress to see how far you’ve come. This provides positive reinforcement and helps you stay on track. Use spreadsheets, budgeting apps, or even a simple notebook to track your payments and debt reduction.

Reward yourself (responsibly!). Celebrate your milestones with small rewards that don’t add to your debt. This could be something as simple as a night out with friends, a new book, or a relaxing activity. The key is to find a balance between rewarding yourself and staying fiscally responsible.

Find a support system. Share your goals with friends, family, or a financial advisor. Their encouragement and support can make a big difference, especially when you face setbacks. Consider joining online communities focused on debt repayment for additional support and motivation.

Stay positive. Remember that setbacks are normal. Don’t let a slip-up derail your entire plan. Learn from your mistakes and get back on track. Maintaining a positive attitude is crucial for long-term success.

Remember your “why”. Why are you working so hard to pay off your debt? Keeping your ultimate goal in mind – whether it’s financial freedom, homeownership, or something else entirely – will provide the necessary drive to persevere.

Who Should Use This Method

The debt avalanche method is particularly well-suited for individuals who are highly motivated and disciplined. Its success hinges on consistent repayment efforts, and a willingness to prioritize one debt over others, even if it has a smaller balance.

This method is ideal for those who are comfortable with a slightly more complex repayment strategy than simply paying the smallest debts first (the debt snowball method). Those who value saving money on interest and want to become debt-free more quickly will find the debt avalanche method appealing.

Individuals with a strong understanding of their finances and a proactive approach to budgeting are likely to find this method effective. The ability to accurately track expenses and allocate funds consistently is crucial to its success. Careful planning and execution are key components of maximizing the benefits of the debt avalanche method.

However, it’s important to note that individuals struggling with significant financial challenges or inconsistent income might find the discipline required by this method difficult to maintain. In such cases, seeking professional financial advice is recommended before implementing any debt repayment strategy.