Understanding your credit card statement is crucial for responsible credit card management. This comprehensive guide will walk you through every section of your statement, helping you decipher the often confusing jargon and understand your account activity, including payments, purchases, interest charges, and fees. By mastering the art of reading your credit card statement, you can effectively track your spending, identify potential errors, and maintain a healthy credit score.

This guide provides a step-by-step process for reading your credit card statement, whether it’s a physical copy or an online version. We’ll cover key elements like the statement period, previous balance, new purchases, payments made, interest accrued, minimum payment due, and your available credit. Learning to interpret these vital pieces of information will enable you to budget more effectively, avoid late payment fees, and ultimately, take control of your personal finances.

Understanding Statement Balance vs. Current Balance

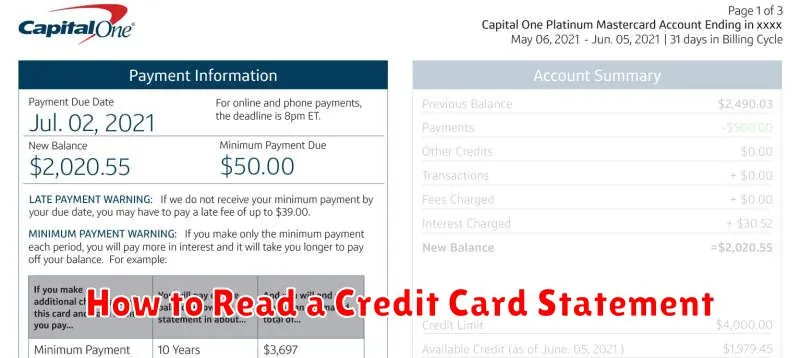

Your credit card statement presents two crucial figures: the statement balance and the current balance. Understanding the difference is key to managing your credit effectively and avoiding late payment fees.

The statement balance represents the total amount you owed as of the statement closing date. This is the amount shown on your statement and the amount you need to pay by the due date to avoid interest charges on that specific amount. It reflects all transactions processed and posted to your account before the statement closing date.

The current balance, on the other hand, is a more up-to-the-minute figure. It’s the total amount you owe at any given time, including any transactions made after the statement closing date. This means that the current balance will always be greater than or equal to the statement balance unless you’ve made payments exceeding your statement balance since the statement closing date.

In short: Pay the statement balance by the due date to avoid interest charges on that specific amount. However, keep in mind that the current balance reflects your ongoing spending and is a useful figure to monitor your total debt.

Paying only the statement balance is a common practice, but actively monitoring your current balance offers better control over your spending and prevents unexpected debt accumulation.

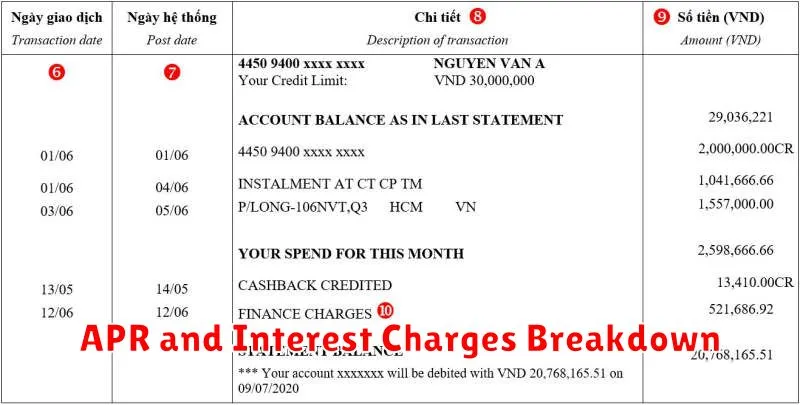

APR and Interest Charges Breakdown

Understanding your Annual Percentage Rate (APR) is crucial to managing your credit card debt effectively. The APR represents the yearly interest rate you’ll pay on your outstanding balance. It’s important to note that this is not a fixed number; many cards have a variable APR that fluctuates based on market conditions and your creditworthiness.

Your statement will clearly display your APR. Look for a section outlining the interest rates applicable to purchases, balance transfers, and cash advances, as these often have different rates. Pay close attention to the details, as a seemingly small difference in APR can significantly impact the total interest paid over time.

The interest charges section of your statement details the amount of interest accrued during the billing cycle. This is calculated based on your average daily balance, your APR, and the number of days in the billing cycle. Understanding this calculation allows you to predict future interest charges and budget accordingly.

To calculate the interest charged, the credit card company typically uses one of two methods: average daily balance (including new purchases) or average daily balance (excluding new purchases). The method used will be specified on your statement. Understanding which method your card issuer employs will help you accurately project future interest payments.

A high average daily balance will inevitably lead to higher interest charges. Therefore, paying down your balance as frequently as possible is essential to minimizing the overall interest paid.

It’s vital to review your statement carefully and ensure the interest charges are accurately calculated based on your APR and balance. If you spot any discrepancies, contact your credit card company immediately to resolve the issue.

Minimum Due and Due Date

Understanding the minimum due and due date on your credit card statement is crucial for avoiding late payment fees and maintaining a good credit score. These two elements work together to define your payment obligations.

The minimum due amount is the smallest payment you can make by the due date to avoid late fees. This amount typically covers interest charges and a small portion of your outstanding balance. It’s important to note that only paying the minimum will likely result in carrying a balance and paying more interest over time, increasing the overall cost of your purchases.

The due date is the date by which your payment must be received by your credit card issuer. Payments received after this date are considered late, and you’ll likely incur a late payment fee. This fee can significantly impact your credit score and increase your overall debt. It’s essential to make sure your payment reaches the issuer by the due date to avoid these penalties.

Always check your statement carefully to identify both the minimum due and the due date. Paying more than the minimum due each month will help you pay down your balance faster, save on interest charges, and improve your financial standing.

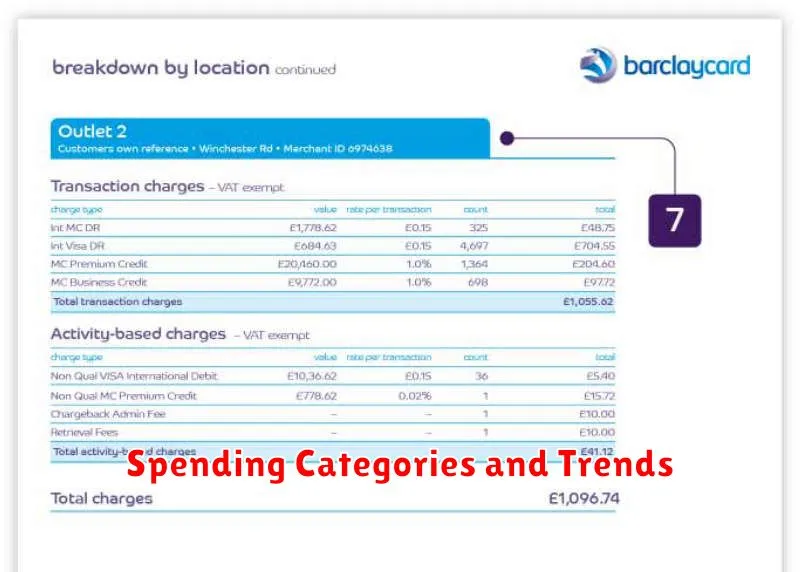

Spending Categories and Trends

Understanding your credit card statement requires more than just checking the total balance. Analyzing your spending categories provides valuable insights into your financial habits. Most statements categorize transactions automatically, grouping similar purchases together (e.g., groceries, dining, transportation).

Tracking these categories reveals spending trends over time. By comparing monthly or quarterly statements, you can identify areas where you consistently overspend. This comparison is crucial for budgeting and financial planning. For example, consistently high spending in the “restaurants” category might suggest a need to curb dining-out expenses.

Many credit card companies offer online tools to visualize your spending patterns. These tools often present data graphically, making it easier to spot spending spikes or recurring patterns. Pay close attention to unexpected increases in particular categories; this could indicate fraudulent activity or a shift in your spending habits requiring further investigation.

Beyond identifying overspending, analyzing spending categories can also highlight areas where you might be underutilizing your credit card. For instance, if you primarily use cash for gas purchases, you’re missing opportunities to earn rewards points or cashback.

Regularly reviewing your spending trends, using the detailed information provided in your statement, allows for proactive financial management. This proactive approach empowers you to make informed decisions about your budget and spending habits, ultimately leading to better control of your finances.

Late Payment Warnings

Your credit card statement will clearly indicate if a payment is late. Look for prominent wording, often in bold or a different color, explicitly stating that a payment was missed or is overdue. The statement will usually specify the amount due, the due date that was missed, and the date the payment was considered late.

Be aware that even a payment made a single day late can trigger a late payment fee. These fees can be significant, adding substantially to your total balance. Statements will clearly show any applied late fees, which are usually itemized separately.

Beyond the fee, a late payment can also negatively impact your credit score. Credit bureaus track late payments, and multiple late payments can significantly lower your score, making it harder to obtain loans or other forms of credit in the future. Your statement may include a notice explaining the potential impact on your credit report.

In addition to explicit late payment warnings, your statement might also highlight the minimum payment amount. Failing to pay at least this minimum amount will also likely result in a late payment designation and the associated consequences. Therefore, always review this amount carefully.

Understanding your statement’s late payment warnings is crucial for managing your finances and maintaining a good credit history. Promptly addressing any late payment notices is essential to avoid additional fees and potential damage to your credit score.

How to Spot Errors

Carefully reviewing your credit card statement is crucial for identifying potential errors. Errors can range from incorrect charges to inaccurate interest calculations, impacting your credit score and finances.

Begin by comparing your statement to your own records. Check each transaction against your receipts, online banking records, or personal spending logs. Note any discrepancies in the amount, merchant name, or transaction date. Even a seemingly small difference warrants further investigation.

Pay close attention to the interest charges. Verify that the interest rate applied matches your agreement and that the calculation is accurate. Review any fees charged, ensuring they are legitimate and correctly applied. Look for any unfamiliar or unauthorized transactions, which may indicate fraudulent activity.

Examine the payment history section of your statement. Confirm that all payments made are accurately reflected. Double check the payment due date and the minimum payment amount to avoid late payment fees.

If you discover any errors, contact your credit card issuer immediately. Report the discrepancy, providing all supporting documentation such as receipts or transaction details. Act promptly to resolve the issue and prevent further complications. Keep a record of all communications with your credit card company.

Remember that prompt action is key to resolving errors quickly and efficiently. By meticulously reviewing your statement and reporting any discrepancies promptly, you can maintain control of your finances and protect your credit health.