Understanding your credit card grace period is crucial for managing your finances effectively and avoiding unnecessary interest charges. This period, typically offered by most credit card issuers, provides a window of opportunity to pay your statement balance in full without incurring any interest. Knowing how long your grace period lasts and how to take full advantage of it can significantly impact your credit score and your overall financial health. This guide will delve into the specifics of credit card grace periods, explaining what they are, how they work, and how to maximize their benefits.

Many cardholders misunderstand or overlook the importance of the grace period, leading to unintentional interest accrual. This can result in significantly higher credit card bills and can negatively affect your credit utilization ratio, a key factor in your creditworthiness. By understanding the nuances of your credit card agreement, specifically the terms concerning your grace period, you can gain control over your finances, avoid unnecessary fees, and build a stronger credit history. This article will equip you with the knowledge to navigate the complexities of credit card grace periods and make informed decisions about your credit card debt.

What Is a Grace Period?

A grace period is a timeframe offered by credit card issuers that allows you to avoid paying interest charges on new purchases. During this period, you can pay your statement balance in full without accruing any interest.

The length of the grace period varies depending on the credit card issuer and can typically range from 21 to 25 days. It’s crucial to understand that this grace period only applies to new purchases; it does not typically extend to balance transfers or cash advances.

To benefit from the grace period, you must pay your entire statement balance by the due date. Paying only a portion of the balance will negate the grace period, and interest will be charged on the remaining amount, going back to the date of purchase.

It’s important to note that some credit cards may not offer a grace period at all, particularly if you have a history of late payments or missed payments. Always review your credit card agreement carefully to understand the specific terms and conditions related to your grace period. Missing the due date, even by a single day, will typically mean losing the grace period for that billing cycle.

Effectively utilizing the grace period is a key aspect of responsible credit card management and can save you considerable money on interest charges over time. Understanding the length of your grace period and ensuring you pay your balance in full by the due date are essential for avoiding unnecessary interest costs.

How It Prevents Interest Charges

A credit card’s grace period is a crucial feature that allows cardholders to avoid paying interest on purchases made during that period. This period typically lasts for 21-25 days, beginning after the closing date of your billing cycle and ending on the due date printed on your statement.

To benefit from the grace period and avoid interest charges, you must pay your statement balance in full by the due date. This means paying the total amount owed, not just the minimum payment. If you only make a minimum payment, you will likely incur interest charges on your remaining balance, even if you paid some of it.

It’s important to note that the grace period generally does not apply to cash advances or balance transfers. These transactions usually accrue interest from the date of the transaction, regardless of whether you pay your statement balance in full by the due date. Always review your credit card agreement for specific terms and conditions regarding your card’s grace period and interest calculations.

Effectively utilizing the grace period is a key strategy for managing your credit card debt and minimizing finance charges. By paying your balance in full within the allotted time, you can avoid accumulating interest and keep your credit card costs to a minimum. Understanding your card’s specific grace period is essential for responsible credit card management.

When You Lose the Grace Period

The grace period on your credit card is a valuable benefit, allowing you to avoid interest charges if you pay your balance in full by the due date. However, this privilege isn’t guaranteed and can be lost under certain circumstances.

One of the most common reasons for losing your grace period is failing to pay your previous month’s balance in full. If you carry a balance from one month to the next, the grace period on subsequent purchases is typically forfeited. This means that interest will accrue on those new purchases from the date of transaction.

Another factor that can impact your grace period is late payments. Even if you eventually pay the full balance, a late payment can trigger interest charges and potentially eliminate the grace period on future purchases for that billing cycle, or even extend to subsequent months depending on your card issuer’s policies.

Certain types of transactions might also affect your grace period. For example, some credit card issuers may not offer a grace period on balance transfers, cash advances, or purchases of certain goods and services. Always review your cardholder agreement to understand which transactions are eligible for the grace period.

Finally, changes in your credit card agreement by the issuer could alter or eliminate the grace period. It’s crucial to regularly review your statements and cardholder agreement for any updates to the terms and conditions, including changes to the grace period policy.

Understanding the conditions that can cause you to lose your grace period is crucial for effective credit card management. By paying your balance in full and on time, and carefully reviewing your cardholder agreement, you can maximize the benefits of your credit card and avoid unnecessary interest charges.

Paying Full vs Minimum Due

Understanding the difference between paying your credit card bill in full versus the minimum due is crucial for managing your finances effectively. The choice significantly impacts your overall credit health and financial well-being.

Paying your balance in full each month offers several key advantages. Most importantly, you avoid paying any interest charges. Credit card interest rates are typically high, and paying only the minimum due can lead to substantial accumulation of interest over time, significantly increasing the total cost of your purchases.

Paying only the minimum due, on the other hand, means you’ll only pay a small fraction of your total balance. While convenient in the short term, this approach allows the remaining balance to accrue interest, potentially leading to a cycle of debt that can be difficult to escape. It can also negatively impact your credit score.

The grace period, the time you have before interest charges begin accruing, is only applicable if you pay your balance in full. If you only pay the minimum, interest starts accruing immediately on the remaining balance from the date of the transaction.

Therefore, prioritizing paying your credit card balance in full each month is the most financially responsible strategy. It helps you avoid high interest charges, maintain a healthy credit score, and keep your finances under control.

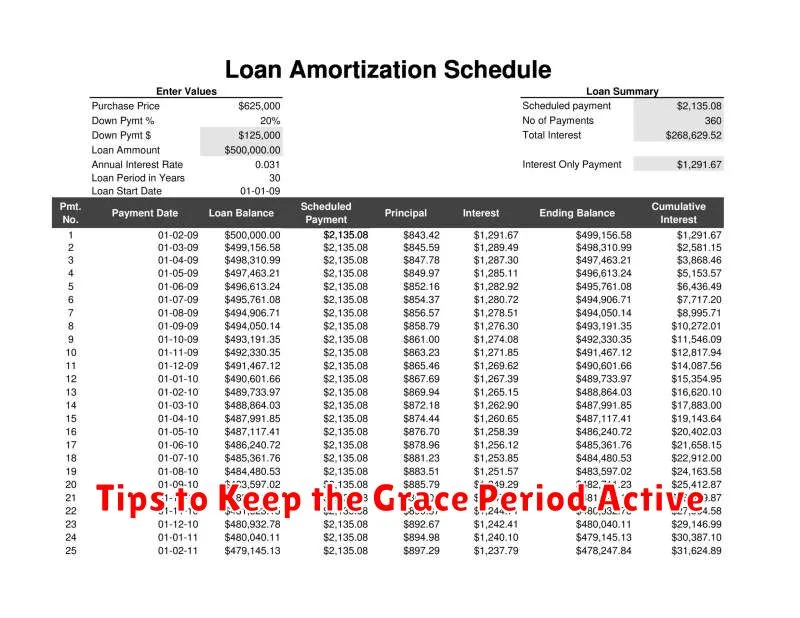

Tips to Keep the Grace Period Active

Maintaining your credit card’s grace period is crucial for avoiding interest charges. This period allows you to pay your statement balance in full without accruing interest. However, several factors can impact your eligibility for this benefit.

Pay your balance in full by the due date. This is the most fundamental requirement. Even a small amount left unpaid can negate the grace period, leading to interest charges on the entire balance from the purchase date.

Understand your statement cycle. Familiarize yourself with your billing cycle and due date. Late payments, even by a day, can eliminate your grace period. Setting up automatic payments can help prevent this.

Avoid cash advances. Cash advances typically do not have a grace period, meaning interest accrues from the moment you withdraw the cash. Opt for regular purchases to leverage the grace period.

Read your credit card agreement carefully. Your credit card agreement outlines the specifics of your grace period, including any conditions that might affect its application. Understanding the terms and conditions will prevent any surprises.

Monitor your account regularly. Check your statement frequently to ensure you’re aware of your balance and due date. This proactive approach can help you prevent late payments and maintain your grace period.

Contact your issuer if you have questions. If you’re unsure about any aspect of your grace period or your account, don’t hesitate to contact your credit card issuer directly for clarification.

How to Maximize Interest-Free Days

Understanding and utilizing your credit card’s grace period is crucial for managing your finances effectively. The grace period, typically 21-25 days, is the time you have to pay your statement balance in full before interest charges begin accruing. Maximizing these interest-free days can significantly save you money over time.

To maximize your interest-free days, focus on paying your balance in full before the due date. Even a single day late can result in interest charges on your entire balance, negating the benefit of the grace period. Therefore, timely payments are paramount.

Strategic spending can also help. If you know you’ll have a large purchase coming up, try to time it so the purchase falls within your current billing cycle, allowing you more time to pay it off within the grace period. However, be mindful of overspending; responsible spending habits are crucial for healthy credit management.

Consistent monitoring of your credit card statement is another key factor. Make sure you understand your statement’s due date and pay close attention to any changes in your grace period, as these can occasionally vary. Using online banking or your credit card company’s app allows for easy tracking and timely payment.

Finally, consider setting up automatic payments. This ensures on-time payments, eliminating the risk of missing a due date and incurring interest charges. While convenient, be sure you have sufficient funds available in your account before setting up automatic payments.