Are you tired of feeling like your money is disappearing before your eyes? Do you dream of financial freedom but struggle to make ends meet? You’re not alone. Many people unknowingly make budgeting mistakes that cost them significant amounts of money each year. These errors can range from seemingly small oversights to major financial missteps, leading to increased debt, missed opportunities, and a constant feeling of being financially strained. This article will explore common budgeting mistakes and provide actionable strategies to help you regain control of your finances and achieve your financial goals. We’ll reveal how avoiding these pitfalls can lead to substantial savings and a more secure financial future.

From underestimating expenses to failing to track your spending effectively, the path to financial stability can be paved with unexpected challenges. Understanding the most prevalent budgeting mistakes – such as neglecting emergency funds, ignoring debt management, and lacking a clear financial plan – is the first step towards rectifying them. This comprehensive guide will equip you with the knowledge and tools to identify your personal budgeting weaknesses and implement effective solutions. Learn how to create a realistic budget, effectively manage debt, and achieve long-term financial success by avoiding these costly errors.

Setting Unrealistic Expense Limits

One of the most common budgeting mistakes is setting expense limits that are too restrictive or, conversely, too lenient. Unrealistic limits, whether overly tight or excessively generous, can derail even the most well-intentioned budgeting plans.

Setting severely low limits on necessary expenses, such as groceries or transportation, often leads to frustration and eventual failure. Individuals may find themselves constantly resorting to unhealthy coping mechanisms, such as skipping meals or foregoing essential maintenance on their vehicles. This can ultimately lead to higher costs down the line in the form of medical bills or unexpected repairs.

On the other hand, setting excessively high limits on discretionary spending, such as entertainment or dining out, can quickly deplete your budget. While allowing for some flexibility is crucial, overly generous limits can easily lead to overspending and a lack of savings. This can create a sense of financial instability and hinder your ability to achieve your long-term financial goals.

The key to successful budgeting lies in establishing realistic and sustainable limits. This requires a careful assessment of your income, expenses, and financial priorities. Consider utilizing budgeting apps or spreadsheets to track your spending and identify areas where you can make adjustments. Remember that a well-structured budget is not about deprivation, but rather about making informed choices that align with your financial objectives.

Forgetting Annual or Irregular Costs

One of the most common budgeting mistakes is neglecting annual or irregular expenses. These are costs that don’t occur monthly, making them easy to overlook when creating a monthly budget.

Examples include car insurance premiums, property taxes, home maintenance (like HVAC servicing or roof repairs), holiday expenses, and professional memberships. Failing to account for these costs can lead to significant financial shortfalls when they are due.

To avoid this pitfall, it’s crucial to create a comprehensive annual budget. List all expected annual or irregular expenses and then divide the total cost by 12 to determine the monthly amount to allocate. This ensures you’re saving consistently throughout the year to cover these predictable yet infrequent costs, preventing unexpected financial strain.

Consider using a spreadsheet or budgeting app to track these expenses. These tools can help visualize your financial picture, making it easier to identify and manage irregular costs effectively. Remember to regularly review and update your budget to reflect any changes in these expenses.

Properly budgeting for these unpredictable costs is essential for maintaining a healthy financial standing and avoiding unnecessary debt or financial stress.

Overcomplicating Categories and Tools

One common budgeting mistake is creating overly complex categories and using excessively complicated budgeting tools. While detailed tracking can be beneficial for some, it often leads to frustration and abandonment. Simplicity is key to long-term budget adherence.

Instead of meticulously categorizing every single expense, focus on establishing a few broad categories that reflect your major spending areas. For example, “Housing,” “Transportation,” “Food,” “Utilities,” and “Entertainment” are generally sufficient for most people. Trying to micro-manage every purchase into dozens of subcategories can be overwhelming and ultimately counterproductive.

Similarly, selecting a budgeting tool should be guided by practicality, not sophistication. Many free or low-cost apps and spreadsheets provide adequate functionality for effective budgeting. Choosing a tool with unnecessary features, complex interfaces, or a steep learning curve can distract from the core goal of financial planning. The best tool is one that you will consistently use.

Remember, the purpose of a budget is to provide a clear overview of your finances and guide your spending. Avoid getting bogged down in unnecessary complexity. A simple, manageable system is far more effective than an intricate one that you’re unlikely to maintain.

Not Adjusting After Life Changes

One of the most common budgeting mistakes people make is failing to adjust their spending plan after significant life changes. Life is dynamic; your financial needs and priorities inevitably shift over time.

Major life events such as marriage, divorce, childbirth, job loss, or a significant salary increase require a reassessment of your budget. Ignoring these changes can lead to serious financial instability. For instance, a new baby necessitates increased expenses related to childcare, diapers, and formula, while a job loss dramatically alters your income stream, requiring immediate adjustments.

Failing to adapt your budget to these new realities can result in overspending, accumulating debt, and ultimately, financial stress. A proactive approach involves regularly reviewing your budget and making necessary alterations to reflect your current circumstances. This might include reducing discretionary spending in certain areas or increasing savings contributions based on your updated income and expenses.

Regular review is key to avoiding this pitfall. Aim to revisit your budget at least quarterly, or even monthly, for significant life transitions. This proactive approach allows you to catch potential problems early on, mitigating the risk of falling into serious financial difficulties.

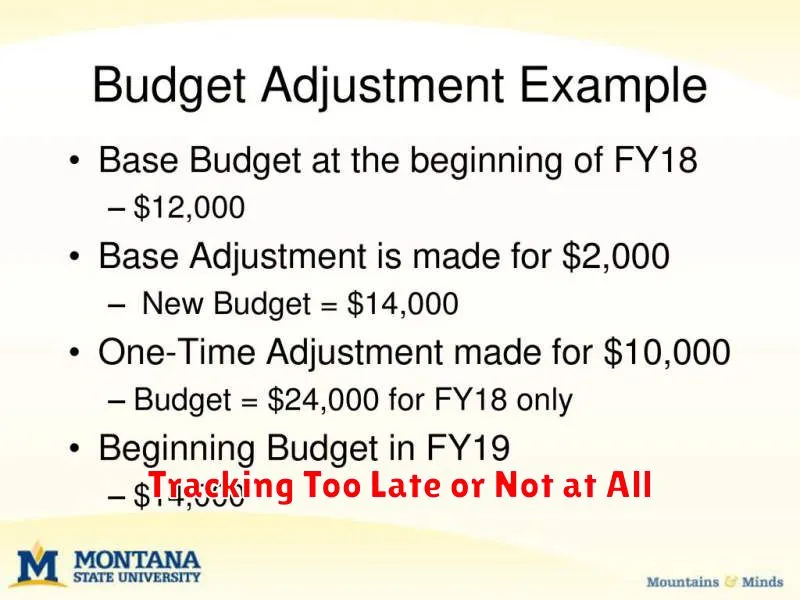

Tracking Too Late or Not at All

One of the most common budgeting mistakes is failing to track spending consistently, or only doing so after significant overspending has already occurred. Effective budgeting relies on real-time monitoring of income and expenses. Waiting until the end of the month, or even worse, until the next statement arrives, renders tracking largely ineffective.

Without regular tracking, it becomes difficult to identify problematic spending habits. Unexpected expenses can easily snowball, leading to significant financial strain. You’re essentially flying blind, unable to course-correct your financial trajectory until it’s too late.

Proactive tracking enables prompt adjustments to spending habits. For example, if you notice you’re exceeding your allocated budget for dining out, you can immediately make changes to reduce future expenses in that category. This prevents the accumulation of debt and helps maintain financial stability.

Therefore, implementing a consistent and timely tracking system is crucial for successful budgeting. Whether you use a spreadsheet, budgeting app, or a simple notebook, the key is to record expenses as they occur to gain a clear understanding of your financial situation and make necessary adjustments proactively.

Skipping the Review Phase Monthly

One of the most common and costly budgeting mistakes is neglecting the crucial monthly review process. While initially setting a budget requires significant effort, the ongoing maintenance and review are equally, if not more, important.

Skipping this step means you’re essentially operating blindly. You won’t know if you’re staying on track with your financial goals, identifying areas of overspending, or discovering potential savings opportunities. This lack of awareness can lead to accumulating debt and falling behind on savings targets.

A thorough monthly review involves comparing your actual spending against your budgeted amounts. This detailed comparison allows you to identify discrepancies and understand where your money is actually going. This process facilitates course correction, enabling you to make necessary adjustments to your spending habits or budget allocation before the situation escalates.

Furthermore, regular reviews provide valuable insights into your spending patterns. This self-awareness is crucial for making informed financial decisions. By analyzing your spending habits, you can identify areas where you can easily cut back or reallocate resources more effectively. This proactive approach can lead to significant long-term savings.

Ignoring the monthly review is akin to driving without looking at the speedometer. You might eventually reach your destination, but the journey will likely be riskier, more expensive, and significantly less efficient. Dedicate time each month to review your budget—it’s a small investment that yields significant returns in financial stability and peace of mind.